Accounting—it’s not the most glamorous part of running a business, but it’s undeniably one of the most important. Whether you’re a startup juggling your first few clients or a growing small business handling multiple projects, you need a system that helps keep your financial house in order without making you feel like you need a degree in accounting. That’s where Xero comes in.

Xero has gained quite the reputation in the world of small and medium-sized businesses. It's a cloud-based accounting platform that promises to streamline your financial processes while offering flexibility and ease of use.

But does it live up to the hype? In this review, we’re going to break down the features that make Xero a favorite for businesses around the globe. We’ll also cover where it might fall short and how it stacks up against other popular tools like QuickBooks and FreshBooks.

Xero

Investing in Xero means smarter, hassle-free financial management. Its cloud-based platform automates invoicing, bank reconciliation, and reporting, saving you time and effort. With seamless integrations, top-tier security, and mobile access, Xero keeps your business finances organized and accessible anytime, anywhere. It’s a reliable choice for businesses looking to streamline operations and stay ahead.

What Makes Xero Stand Out?

Let’s start with the basics: Xero is an online accounting platform that’s specifically built for small to medium-sized businesses (SMBs). What sets Xero apart is its focus on making accounting less intimidating for people who don’t have a background in finance. It’s like having an accountant on your team—without the extra payroll cost.

Key Features That Matter - Xero Review

1. Invoicing Without the Hassle

Creating and sending invoices can feel like a chore, but Xero makes it smooth and straightforward. You can customize invoices, send them directly from the platform, and set up automatic payment reminders for those clients who might need a gentle nudge. Plus, if you’ve got recurring clients, you can set up recurring invoices and let Xero handle it for you.

Example: Say you're a consultant with monthly retainer clients. Instead of manually creating an invoice each month, you set it up once, and Xero automatically sends it on the same date every month. Simple, right?

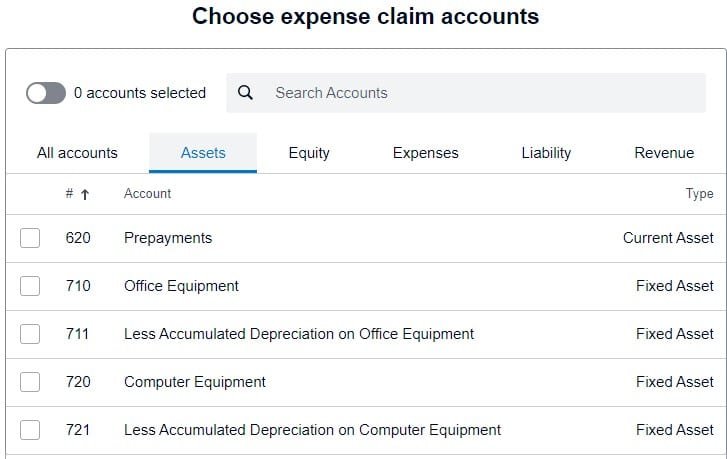

2. Expense Tracking—

Tracking your expenses doesn’t have to involve a pile of crumpled receipts. Xero’s mobile app allows you to take photos of receipts and match them to your expenses instantly. It syncs with your bank accounts and credit cards to automatically import transactions, so you don’t miss a beat.

Real-World Scenario: Let’s say you run a small construction company. With Xero, you can track every tool, lunch meeting, and travel expense, linking them to specific projects. This way, you know exactly where your money’s going.

3. Bank Reconciliation in a Few Clicks

No one likes sifting through bank statements to reconcile their books, but Xero makes it easier than most. You can sync your bank accounts, and Xero automatically imports transactions. All you have to do is approve the matches. You can also set up rules to automate how transactions are categorized, speeding things up even more.

4. Keeping Tabs on Inventory

If your business sells physical products, Xero’s inventory tracking feature will save you time and headaches. It tracks stock levels, updates quantities when you make sales, and helps you stay on top of what needs to be reordered.

5. Payroll (But Check Your Country)

Xero offers payroll services, which can be a lifesaver for businesses managing a team. However, this feature is only available in a few select countries like the US, UK, and Australia. If you’re in one of those regions, Xero can handle your payroll, file taxes, and manage employee records. Outside of these areas, you may need to find a separate solution.

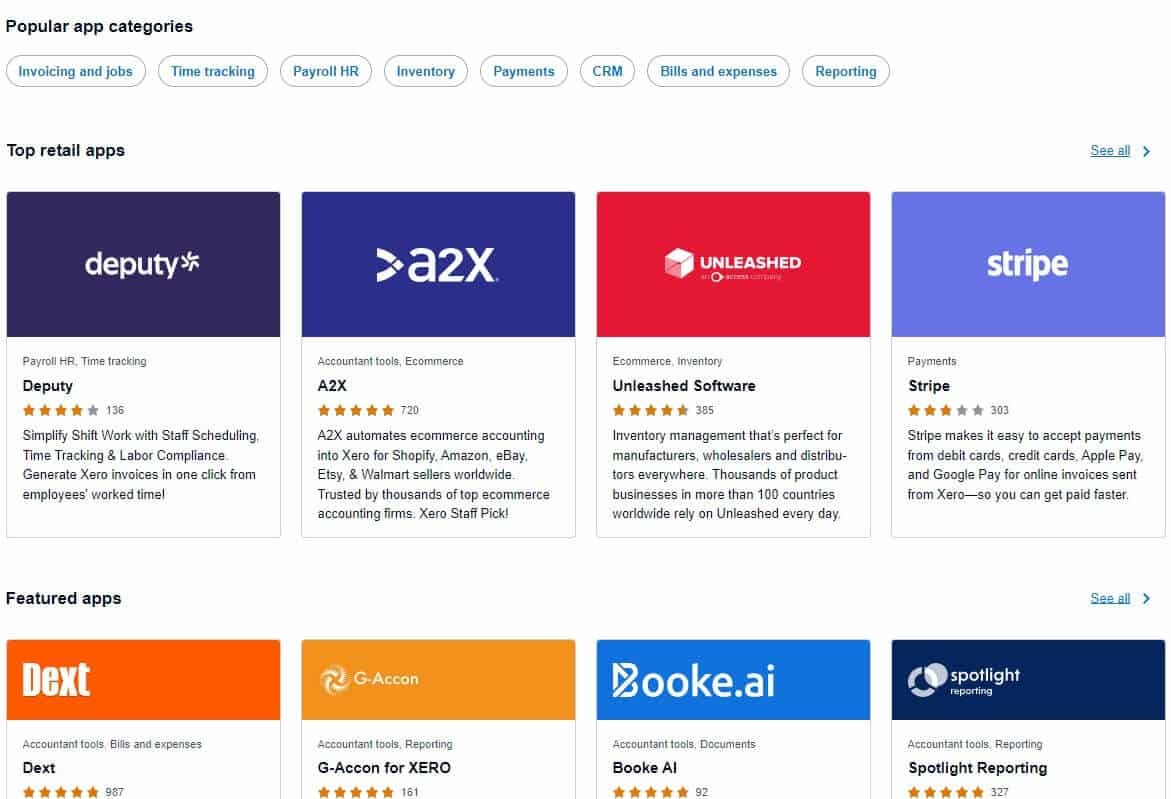

6. Integration

Xero doesn’t just do it all itself—it plays well with others. It integrates with over 1,000 third-party apps, including popular tools like Stripe, PayPal, Shopify, and even your CRM software. If you’re running an e-commerce business or need to sync up with other platforms, Xero’s got you covered.

Example: An online boutique selling through Shopify can sync its store with Xero, automating sales, tracking inventory, and reducing manual data entry.

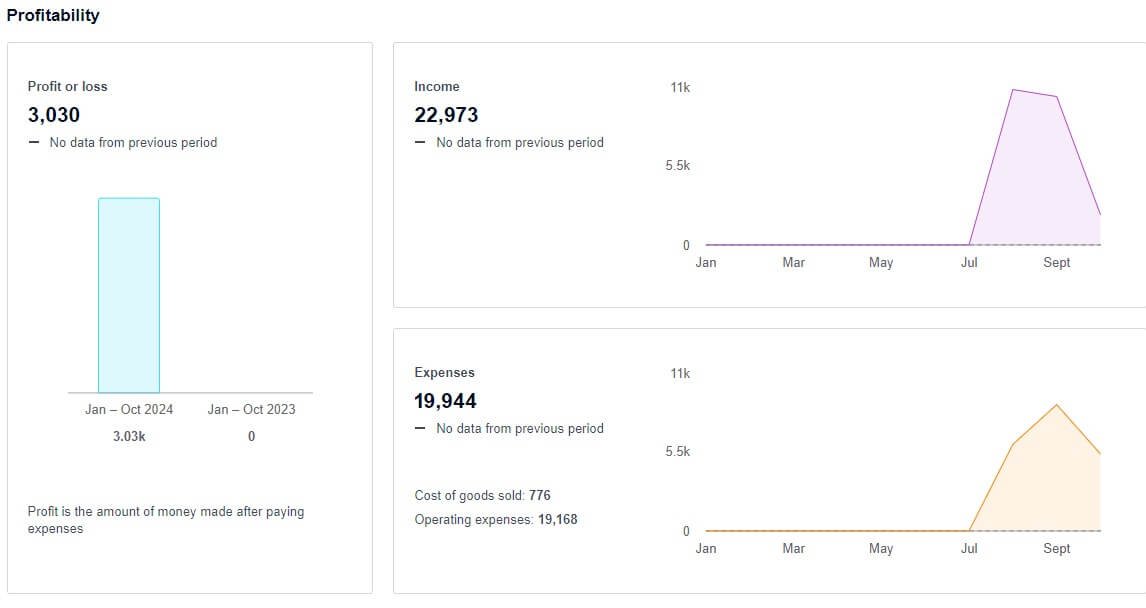

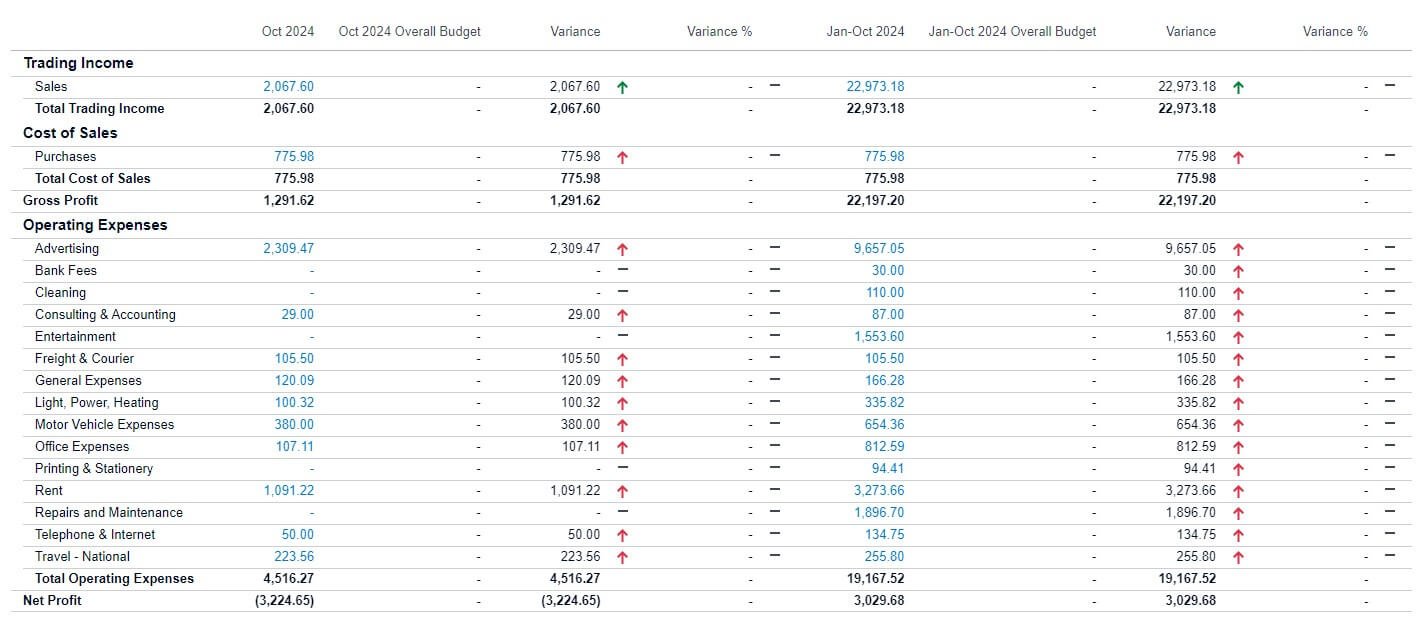

7. Real-Time Financial Reporting

Xero’s reporting tools give you everything you need to stay on top of your business’s financial performance—without drowning in spreadsheets. Let’s dive into some of the key features that help you understand how your business is really doing, and make smarter decisions along the way.

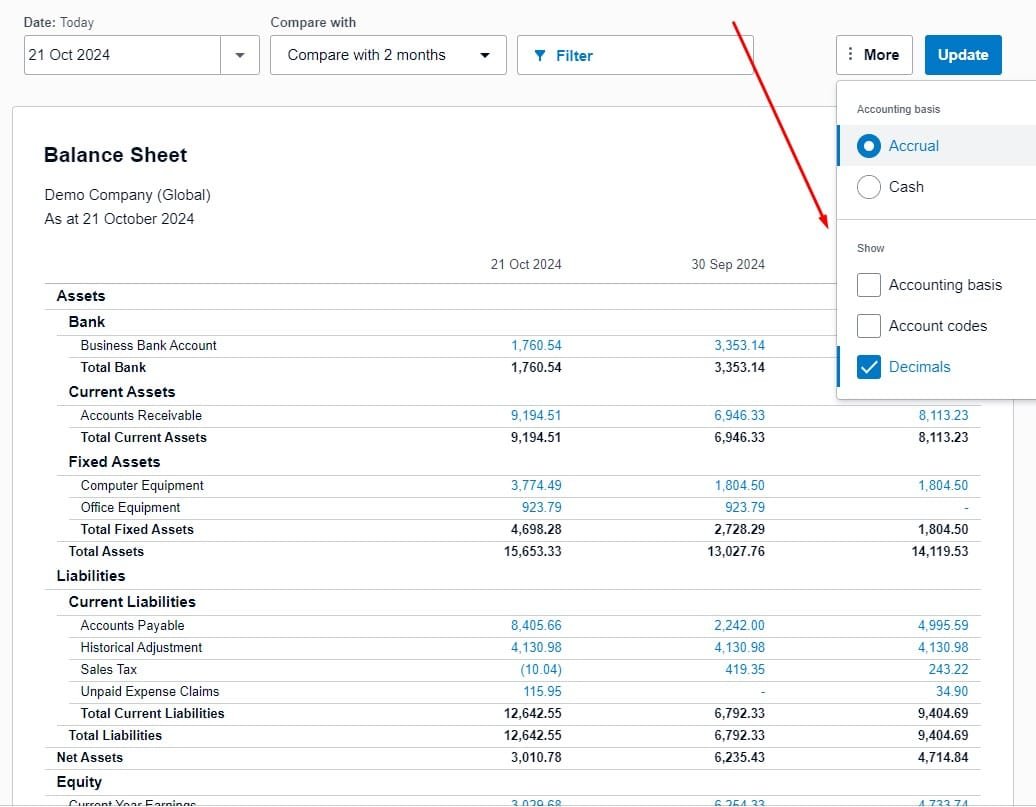

Stay on Top of Your Financial Health

One of the biggest perks of Xero is how easily you can see your overall financial position. With just a glance, you’ll get the big picture of what’s coming in, what’s going out, and where you stand right now. The Balance Sheet helps you track what your business owns and owes at any given time, while financial statements give a detailed breakdown of revenue, costs, liabilities, assets, and equity.

Business Insights at Your Fingertips

Ever wondered how “healthy” your business really is? Xero’s Business Snapshot dashboard is like your financial pulse check, showing key metrics and trends that let you know how things are shaping up. And if you’re trying to get a better sense of where your cash is heading in the near future, the Short-term Cash Flow feature gives you a clear picture, so you’re not left guessing.

Budgeting That Actually Works for You

Xero makes budgeting a breeze with its Budget Manager. You can easily set goals and keep an eye on how you’re tracking throughout the year. Plus, the Budget Summary and Budget Variance reports let you see how your actual numbers stack up against what you planned, helping you adjust before any surprises pop up.

Dig Deeper into Your Business Performance

For a more in-depth look at how your business is doing, Xero offers a range of graphs and financial ratios with its Business Performance reports. Whether it’s profitability, cash flow, or efficiency, these reports break down the numbers in a way that’s easy to understand. Speaking of cash, the Cash Summary shows exactly how money is moving in and out of your business.

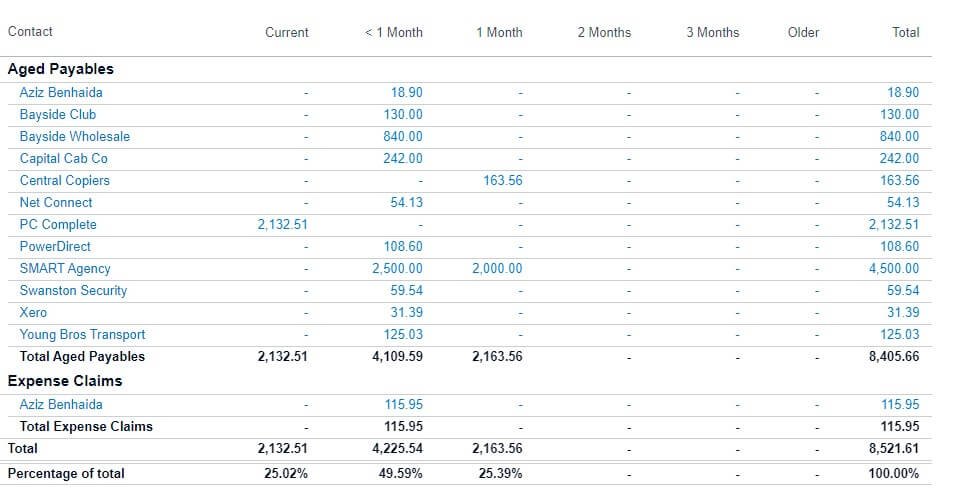

Keep Payables and Receivables in Check

Xero’s reporting also makes it easy to keep track of what you owe and what’s owed to you. Reports like Aged Payables and Aged Receivables give you a clear view of outstanding bills and invoices—so you can manage payments without a hassle. Plus, the Receivable/Payable Invoice Summaries give you a quick snapshot of who owes you what and who you need to pay.

Get Clear Insights on Payroll

When it comes to payroll, Xero’s got you covered too. You can track how much you’re paying your employees, broken down by pay run, pay type, or pay item. This makes managing your payroll straightforward, whether you’re looking at individual employees or overall payroll activity.

Manage Projects with Ease

If your business is project-based, Xero’s Project Financials and Project Summary tools give you all the data you need to stay on budget and keep projects profitable. From tracking expenses to managing estimates, these features help you keep a handle on everything.

Make Reconciliations Simple

Bank reconciliations don’t have to be a headache. With Xero, you can easily compare your business’s bank balance with what’s in Xero and catch any missing or duplicated transactions before they become a problem. The Reconciliation Reports keep things neat and tidy, so your books are always in order.

Taxes, General Ledger, and More

Xero also makes it easy to stay on top of taxes and your general ledger. The Sales Tax Report helps you stay compliant with tax reporting, and the General Ledger Detail and Trial Balance reports give you a crystal-clear view of your business’s financial activity. Whether it’s reconciling tax records or reviewing journal entries, you’ll always know where you stand.

In short, Xero takes the guesswork out of financial reporting. With all these tools at your disposal, you can make better decisions, stay on track with your goals, and get a handle on your business’s performance—all without drowning in data or feeling overwhelmed.

8. Mobile App for On-the-Go Finances

Whether you’re traveling for work or just prefer managing your business from your phone, Xero’s mobile app is super functional. You can send invoices, approve transactions, and even reconcile your bank accounts from your smartphone or tablet.

The Good: Xero’s Advantages

Pros

Cons

Xero vs. QuickBooks vs. FreshBooks

QuickBooks Online

QuickBooks is the titan of the small business accounting world, and it’s easy to see why. Like Xero, it offers invoicing, bank reconciliation, and reporting. Where QuickBooks pulls ahead is its more robust payroll features and deeper reporting capabilities, especially for larger or more complex businesses. However, it comes at a higher price point, and the interface can feel a bit clunkier for those who aren’t already familiar with accounting.

FreshBooks

FreshBooks is often the go-to for freelancers and service-based businesses. It’s got strong project management and time-tracking tools that make it ideal for creatives and contractors who bill by the hour. However, FreshBooks isn’t as strong on inventory management or handling complex financial needs, making Xero a better fit for product-based businesses or growing SMBs.

How Businesses Really Benefit from Xero

1. The Freelancer:

Imagine you’re a freelance graphic designer, juggling multiple clients, deadlines, and invoices. Xero can step in and make life a whole lot easier. Instead of manually chasing down payments, you can send sleek, professional invoices and let Xero do the follow-up for you with automatic reminders.

You can also track every expense—whether it's that fancy new tablet or coffee with a client—making tax time less of a nightmare. No more scrambling through receipts. Plus, getting paid online? Just a few clicks away. You get to spend less time on admin and more time creating.

2. The Retailer:

Running a small retail store, whether online through Shopify or on the high street, means dealing with inventory, sales data, and keeping an eye on your finances all at once. Xero syncs with your e-commerce platform to track everything in real-time, so you always know what’s selling and when it’s time to restock.

Plus, those automatic bank reconciliations? They take a huge chunk of work off your plate, letting you stay on top of your finances without drowning in paperwork. No more hunting down mismatched payments. It's all seamless, leaving you free to focus on your customers.

3. The Construction Company:

If you’re in construction, you know how important it is to keep track of every project’s costs—whether it’s materials, labor, or subcontractor fees. Xero helps by breaking down costs on a project-by-project basis, showing you exactly where your money’s going and which jobs are actually profitable. Plus, with real-time financials, there’s no guessing whether a project is making or losing money. You get all the numbers upfront, so you can make smart decisions, fast.

4. The Nonprofit Organization:

For nonprofits, tracking donations, budgets, and ensuring every penny is well-accounted for can feel like a full-time job. With Xero, you can categorize income and expenses easily, whether it’s from fundraising events, donations, or grants. You can also generate reports that meet the strict regulatory requirements nonprofits need to follow. Plus, integrating Xero with your donor management system means you can handle fundraising campaigns and donor relationships without all the extra legwork. It’s a win-win for you and your mission.

5. The Hospitality Business:

Whether you run a cafe, a restaurant, or a hotel, managing your daily cash flow can be a headache—especially when you’re dealing with different payment methods like credit cards, cash, and online reservations. Xero connects with your POS system, meaning all those transactions get synced automatically. Vendor payments, inventory, payroll for your staff—it’s all managed in one place. And you get a clear view of your cash flow, so you know exactly how your business is performing, day by day.

6. The Digital Agency:

Digital agencies often juggle several projects at once, and keeping track of billable hours can get messy. Xero simplifies this by helping you log time, track expenses, and create detailed invoices for clients. Plus, when you’re managing client retainers or recurring payments, Xero handles the heavy lifting by automating it all. Working with international clients? Xero’s multi-currency support ensures payments are smooth and hassle-free. It helps you focus on delivering results rather than managing the numbers.

7. The Consulting Firm:

Consulting can involve tracking a lot of moving pieces—client projects, billable hours, expenses—it adds up quickly. Xero helps you stay on top of things by managing client billing and tracking project budgets in real-time. You’ll know exactly which projects are profitable, and which ones need more attention. Plus, Xero’s time-tracking integration makes it easy to capture billable hours and convert them straight into invoices. That’s less time spent on admin, and more time helping your clients.

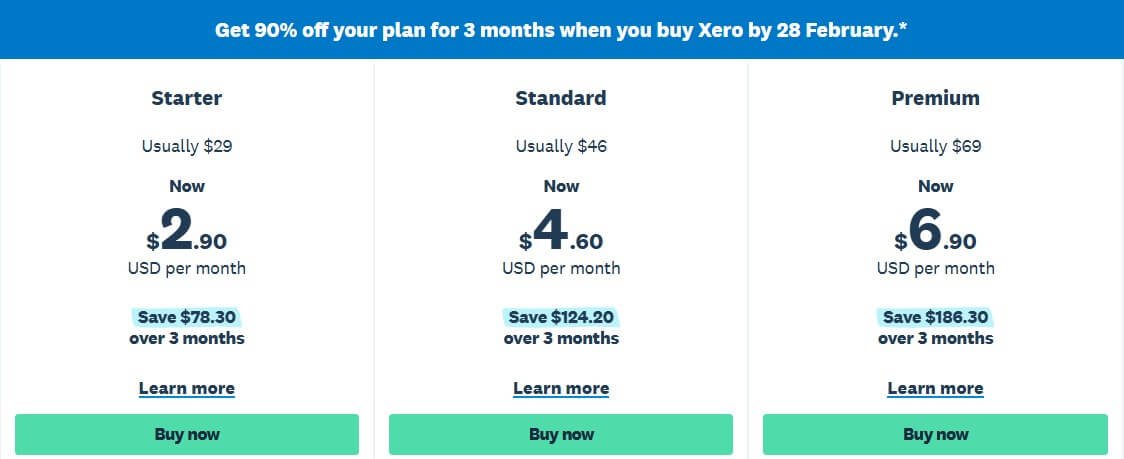

Xero Pricing: What’s It Going to Cost?

Xero offers three pricing plans, which makes it flexible depending on where your business is in its growth cycle. Here’s a breakdown:

50% discount on your Xero subscription for the first three months.

f you're looking for a powerful accounting solution, Xero has an offer that can help you get started without a big upfront cost. You can now receive a 50% discount on your Xero subscription for the first three months.

This promotion is a great way for you to experience all of Xero's features and streamline your business's financial management. After the initial three-month period, your subscription will continue at the standard monthly rate for the plan you've chosen. This limited-time offer is the perfect opportunity for you to save money while bringing efficiency and clarity to your accountin

Starter Plan: $13/month

This is the entry-level plan and best suited for solopreneurs or freelancers just getting started. You can send up to 20 invoices, enter five bills, reconcile your bank transactions, and capture bills and receipts.

Standard Plan: $37/month

This plan is Xero’s most popular and offers everything from the Starter plan but with no limits on invoices or bills. Perfect for growing small businesses that need more flexibility and power without breaking the bank.

Premium Plan: $70/month

If your business deals with multiple currencies, the Premium plan is for you. It includes everything in the Standard plan, plus the ability to reconcile payments and bills in different currencies. Great for businesses with global clients or suppliers.

Xero also offers a 30-day free trial, so you can test the waters before committing. Plus, there’s optional add-ons, such as Payroll with Gusto (in the US) for an additional fee if you need it.

Should You Go with Xero?

If you’re running a small or growing business and need a tool that multiple team members can easily access, Xero is definitely worth considering. It’s not just an accounting software; it’s your all-in-one finance manager.

From handling invoicing to payroll (thanks to its smooth integration with Gusto), Xero keeps things organized so you can focus on growing your business instead of drowning in spreadsheets. The navigation could be a bit more intuitive, but honestly, it doesn’t stop Xero from getting the job done when it comes to number crunching.

That said, Xero might not be everyone’s cup of tea. If it doesn’t quite hit the mark for you, there are other strong options out there. QuickBooks Online is a powerhouse, offering a solid mix of robust accounting features and user-friendly design—making it a great pick if you want something comprehensive.

On the other hand, if you’re a freelancer or an independent contractor needing something more straightforward, FreshBooks could be a better fit. It’s super easy to use and perfect for solo entrepreneurs who want to streamline invoicing and expense tracking.

In the end, it’s all about finding the right tool that fits your business and workflow. Xero has a lot to offer, but it’s good to know you’ve got options!

FAQs About Xero

Is Xero suitable for freelancers?

Absolutely! Xero’s Starter plan is budget-friendly and offers all the essential features a freelancer needs, like invoicing, expense tracking, and bank reconciliation. It’s also great if you need to accept online payments or track income from multiple clients.

Does Xero have a mobile app?

Yes! Xero’s mobile app is designed for on-the-go business owners. Whether you’re traveling or working remotely, you can send invoices, capture receipts, and even reconcile transactions from your phone.

Can I integrate Xero with my e-commerce platform?

Yes, Xero integrates with Shopify, WooCommerce, and many other e-commerce platforms. This makes it easy for online sellers to automate their sales data and track inventory seamlessly.

What countries is Xero’s payroll available in?

Payroll through Xero is available in the US, UK, Australia, and New Zealand. If you’re in other countries, you’ll need to use a third-party payroll service and integrate it with Xero.

How does Xero compare to QuickBooks?

Xero is generally more user-friendly, with a simpler interface that non-accountants appreciate. QuickBooks offers more advanced features, particularly in payroll and reporting, but it comes at a higher price point. Xero’s pricing is also more straightforward, without the tiered limitations that QuickBooks often has.

Is customer support available 24/7?

Xero offers 24/7 online support, but it’s mostly through email or their help center. There isn’t a live chat or phone support option, which can be frustrating if you need immediate assistance.

Does Xero handle inventory management?

Yes, Xero has a built-in inventory management system that helps track stock levels, automatically updates quantities when you make sales, and assists with reordering. It’s perfect for small product-based businesses.

The Bottom Line: Who Is Xero Best For?

Xero is an excellent fit for small and medium-sized businesses, especially those that want a user-friendly, scalable platform with strong integration capabilities.

It’s great for business owners who don’t have an accounting background and need something that can grow with them. Xero’s affordability and flexibility make it a solid choice for startups, freelancers, retail businesses, and companies that deal with inventory.

That said, if you need more advanced project management or if payroll is a critical part of your business and Xero doesn’t support your country, you might find QuickBooks or another competitor a better fit.

Ultimately, Xero strikes a nice balance between simplicity and power—making it one of the most popular accounting platforms for businesses

Affiliate Disclosure

This article may contain affiliate links: means , if you click on one of these links and make a purchase ( which we appreciated ), then I'll receive a small commission without affecting the original price ( without costing you anything extra ).