Looking for the Best Accounting Software Small Business? Explore top-rated options that simplify bookkeeping, enhance productivity, and scale with your growth.

Ever felt overwhelmed by the mountain of paperwork that comes with running a small business? Are you tired of spending countless hours juggling spreadsheets and trying to make sense of your finances?

It's time to simplify your accounting and focus on what truly matters: growing your business. The right accounting software can be a game-changer.

With so many options available, how do you choose the best one for your unique needs? In this comprehensive guide, we'll explore the top 14 accounting software solutions tailored for small businesses. From budget-friendly options to feature-rich platforms, we'll help you find the perfect fit.

Get ready to streamline your finances, save time, and make informed business decisions. Let's dive into the world of accounting software and discover how it can transform your small business.

What is Accounting Software?

Accounting software is a digital tool designed to streamline and automate various financial tasks for businesses. It serves as a central hub for managing financial data, providing insights, and facilitating decision-making. Key functions include:

Benefits of Accounting Software.

Accounting software significantly enhances the efficiency and accuracy of financial management. By automating tasks, providing real-time insights, and improving data integrity, it empowers businesses to make informed decisions and streamline their operations.

Key benefits include:

- Improved Efficiency and Accuracy: Automated data entry, real-time updates, and data consistency reduce errors and save time.

- Enhanced Financial Insights: Generate comprehensive reports, analyze data, and forecast future trends to make informed decisions.

- Time and Cost Savings: Reduce manual work, improve productivity, and save money on labor, paper, and storage costs.

- Better Compliance: Simplify tax preparation, audits, and regulatory compliance.

- Improved Collaboration: Enable real-time access and collaboration among team members and stakeholders.

- Additional Features: Inventory management, payroll processing, expense tracking, and CRM integration.

By leveraging the capabilities of accounting software, businesses can optimize their financial processes, gain a competitive edge, and achieve greater success.

Key Statistics

- Global Accounting Software Market: Estimated to reach $11.7 billion by 2026 (Source: ResearchAndMarkets)

- Cloud Accounting Market: Expected to grow at a CAGR of 12.7% from 2023 to 2030 (Source: Grand View Research)

- Automation in Accounting: Over 50% of accounting tasks are expected to be automated by 2025 (Source: Deloitte)

How to Choose the Best Accounting Software Small Business

Are you overwhelmed by the countless accounting software options available for small businesses? Don't worry, you're not alone. Selecting the right software can significantly impact your business's efficiency and financial management. Here's a guide to help you make an informed decision:

1. Assess Your Business Needs:

- Size and complexity: Consider your business's current size and projected growth. A simple system might suffice for a small startup, while a more robust solution may be necessary for a growing enterprise.

- Industry-specific requirements: Some industries have unique accounting needs. Research software that caters to your specific industry to ensure compliance and efficiency.

- Scalability: Choose software that can grow with your business. Look for features that allow for easy customization and expansion as your operations evolve.

2. Consider Key Features.

- Invoicing and billing: Efficient invoicing and billing processes are crucial for timely payments. Look for software that offers customizable templates, automated reminders, and online payment options.

- Expense tracking: Streamline expense management with features like expense reports, categorization, and integration with credit cards.

- Inventory management: If your business deals with inventory, ensure the software can track stock levels, reorder points, and manage purchase orders.

- Financial reporting: Robust reporting capabilities are essential for analyzing your business's financial performance. Look for software that generates customizable reports, including income statements, balance sheets, and cash flow statements.

- Payroll processing: If you handle payroll in-house, consider software that automates payroll calculations, tax filings, and direct deposit.

3. Evaluate Ease of Use

- User interface: A user-friendly interface can save time and reduce errors. Look for software with intuitive navigation, clear labeling, and helpful tutorials.

- Mobile accessibility: If you need to access your accounting data on the go, choose software with a mobile app or responsive web design.

4. Consider Cost and Support.

- Pricing: Compare pricing plans and features to find the best value for your money. Consider factors like monthly or annual subscription fees, additional costs for add-ons, and implementation fees.

- Support: Look for software providers that offer excellent customer support. Consider factors like response time, availability of training resources, and community forums.

By carefully considering these factors, you can choose the accounting software that best suits your small business's needs and helps you achieve financial success.

XERO

Xero isn't just another accounting software; it's a revolution. This cloud-based platform has transformed the way businesses manage their finances, offering features that are both intuitive and powerful. With real-time updates, seamless integrations, and easy collaboration, Xero empowers businesses to make informed decisions and optimize their financial performance

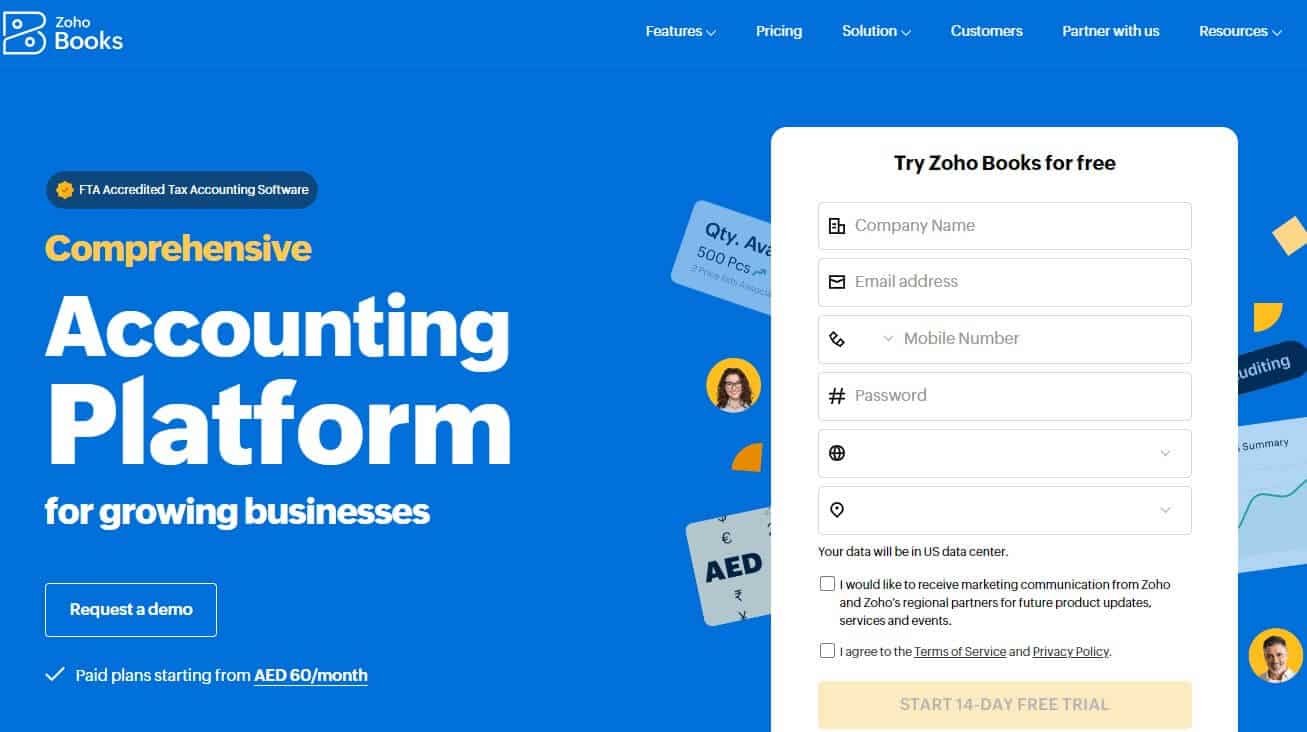

Zoho Books

Zoho Books is a cloud-based accounting software that can help you manage your finances, from invoicing and expense tracking to inventory management and payroll. It's designed to be user-friendly, so you don't need to be an accounting expert to use it. See Review. Receive a $100 credit directly into your account!

FreshBook

Imagine FreshBooks as your friendly, online accountant. It's like having a personal assistant who helps you manage your business finances. With FreshBooks, you can easily create and send invoices, track your expenses, manage your time, and even accept payments online. It's like having a reliable financial partner.

Xero

Xero is a cloud-based accounting software designed to streamline financial management for businesses of all sizes. It offers a comprehensive suite of features, including invoicing, expense tracking, payroll, and financial reporting. Xero is known for its user-friendly interface, integration capabilities, and focus on small business needs.

The platform operates on a subscription-based model, allowing users to access their accounts from anywhere with an internet connection. Xero offers a range of features to help businesses manage their finances efficiently, including:

- Invoicing: Creating and sending professional invoices to customers.

- Expense tracking: Recording and categorizing expenses, including mileage and time tracking.

- Payroll: Processing payroll, handling tax deductions, and issuing paychecks.

- Financial reporting: Generating various financial reports, such as income statements, balance sheets, and cash flow statements.

- Inventory management: Tracking stock levels, costs, and sales.

- Bank reconciliation: Automatically reconciling bank accounts with transactions in Xero.

Xero is well-suited for a wide range of businesses, from small startups to established enterprises. Its versatility and scalability make it adaptable to different business structures and growth stages.

Features and Benefits

Xero offers a robust set of features that can significantly enhance financial management efficiency and provide valuable insights into business performance. Some of the standout features include:

- User-friendly interface: Xero is designed to be intuitive and easy to use, even for those with limited accounting experience.

- Integration capabilities: Xero integrates seamlessly with other popular business applications, such as payment gateways, time tracking tools, and CRM systems.

- Financial reporting: Xero provides customizable financial reports that offer a clear and comprehensive view of a business's financial health.

- Mobile access: The cloud-based nature of Xero allows users to access their accounts and manage financial tasks from their smartphones or tablets.

- Customer support: Xero offers reliable customer support resources, including online help, tutorials, and live chat assistance.

By leveraging these features, businesses can improve their financial accuracy, enhance productivity, and make data-driven decisions to support growth.

Xero Pros and Cons

While Xero is a powerful accounting tool, it's important to consider both its strengths and weaknesses to make an informed decision.

Pros

Cons

Is Xero Right for You or Your Business?

Whether Xero is the right choice for you or your business depends on several factors, including your business size, industry, and specific accounting needs.

For small and medium-sized businesses, Xero offers a comprehensive and affordable solution. Its user-friendly interface and essential features make it a suitable choice for managing basic accounting tasks.

Larger enterprises may also benefit from Xero, especially if they require features such as inventory management, payroll processing, and advanced reporting. However, businesses with highly complex accounting needs may require more specialized software or custom integrations.

If you are in a service-based industry that relies heavily on invoicing and customer management, Xero's features can be particularly valuable. For businesses in manufacturing or retail, the software's inventory management capabilities can help streamline operations.

Ultimately, the best way to determine if Xero is right for you is to evaluate your specific needs and compare it to other available options. Consider factors such as pricing, features, scalability, and customer support when making your decision.

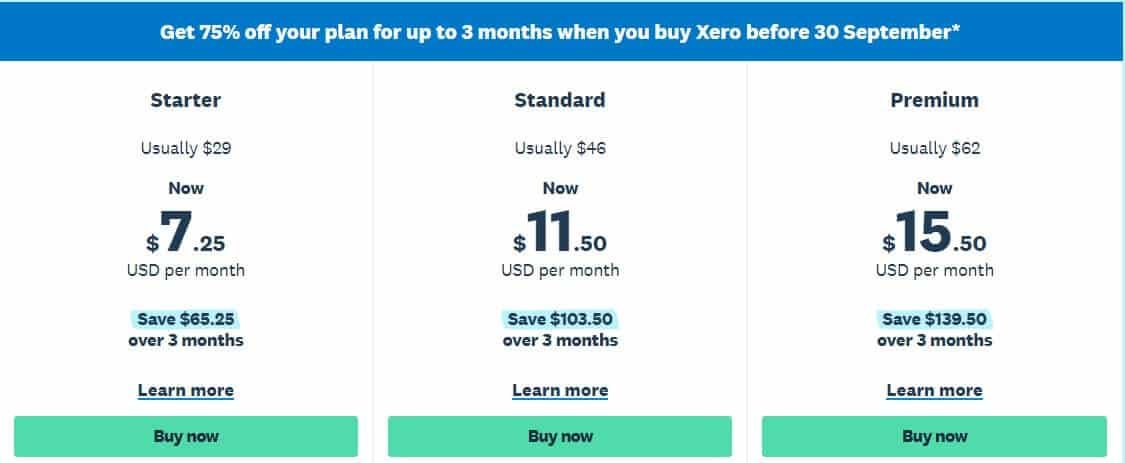

Xero Pricing Structure

Xero offers several pricing tiers to accommodate businesses of different sizes and needs. Each tier includes a specific set of features and comes with a monthly subscription fee.

Xero offers three main subscription plans:

- Starter: Ideal for small businesses, this plan provides basic accounting features.

- Standard: Suitable for growing businesses, this plan includes additional features like advanced reporting and multi-currency support.

- Premium: Designed for larger businesses, this plan offers the most comprehensive set of features, including advanced inventory management and workflow automation.

Xero's pricing can vary based on your location and subscription choices. To get the exact cost for each tier, visit the Xero website or reach out to their sales team.

Xero Verdict

Overall, Xero is a powerful and versatile accounting software that can streamline financial management for businesses of all sizes. Its user-friendly interface, integration capabilities, and comprehensive features make it a valuable tool for improving efficiency and accuracy.

While Xero may have limitations in terms of pricing and customization options for larger businesses, its overall benefits often outweigh these drawbacks. If you are looking for a reliable and user-friendly accounting solution, Xero is definitely worth considering.

QuickBooks

QuickBooks is a popular cloud-based accounting software designed to streamline financial management for small and medium-sized businesses. Its primary purpose is to help users track income, expenses, and cash flow, generate invoices, manage inventory, and handle payroll.

The platform's user-friendly interface makes it accessible to both accounting professionals and business owners with limited financial expertise. QuickBooks offers a variety of key functionalities, including:

- Income and expense tracking: Easily record and categorize income and expenses, providing a clear overview of a business's financial performance.

- Invoicing and payments: Create and send professional invoices, track payments, and accept online payments.

- Inventory management: Manage inventory levels, track stock movements, and calculate costs of goods sold.

- Payroll processing: Handle payroll efficiently, including calculating wages, taxes, and deductions.

- Financial reporting: Generate various financial reports, such as income statements, balance sheets, and cash flow statements, to gain insights into a business's financial health.

While QuickBooks is suitable for a wide range of businesses, it is particularly well-suited for those that require a comprehensive accounting solution without the complexity of enterprise-level software.

Features and Benefits

QuickBooks offers a robust set of features that can significantly benefit users:

- Automation: QuickBooks automates many time-consuming tasks, such as bank and credit card reconciliations, saving users time and reducing the risk of errors.

- Integration: QuickBooks seamlessly integrates with other popular business applications, such as payment gateways, time tracking software, and CRM platforms, streamlining workflows and improving efficiency.

- Scalability: As a business grows, QuickBooks can easily adapt to changing needs, offering a variety of plans and features to accommodate expansion.

- Customer support: QuickBooks provides excellent customer support, including online resources, tutorials, and live chat assistance, ensuring users have access to help when needed.

- Mobile accessibility: The QuickBooks mobile app allows users to access their financial data and perform key tasks on the go, providing flexibility and convenience.

Pros

Cons

Is QuickBooks Online Right for You or Your Business?

QuickBooks Online offers a versatile solution for many businesses, but its suitability depends on various factors.

For small businesses and sole proprietors, QuickBooks Online's user-friendly interface and essential features make it an ideal choice for managing basic accounting tasks. Its affordable pricing and comprehensive functionality cater well to the needs of these businesses.

While QuickBooks Online can handle the needs of mid-sized businesses, it's particularly well-suited for those requiring features like inventory management, payroll processing, and advanced reporting. However, larger enterprises with complex accounting needs might benefit from more specialized software or custom integrations.

QuickBooks Online's invoicing and customer management features are particularly valuable for service-based industries. For businesses in manufacturing and retail, the software's inventory management capabilities can streamline operations.

To determine if QuickBooks Online is the best fit for your business, carefully evaluate your specific needs and compare it to other available options. Consider factors such as pricing, features, scalability, and customer support. By assessing these elements, you can make an informed decision that aligns with your business's goals and requirements.

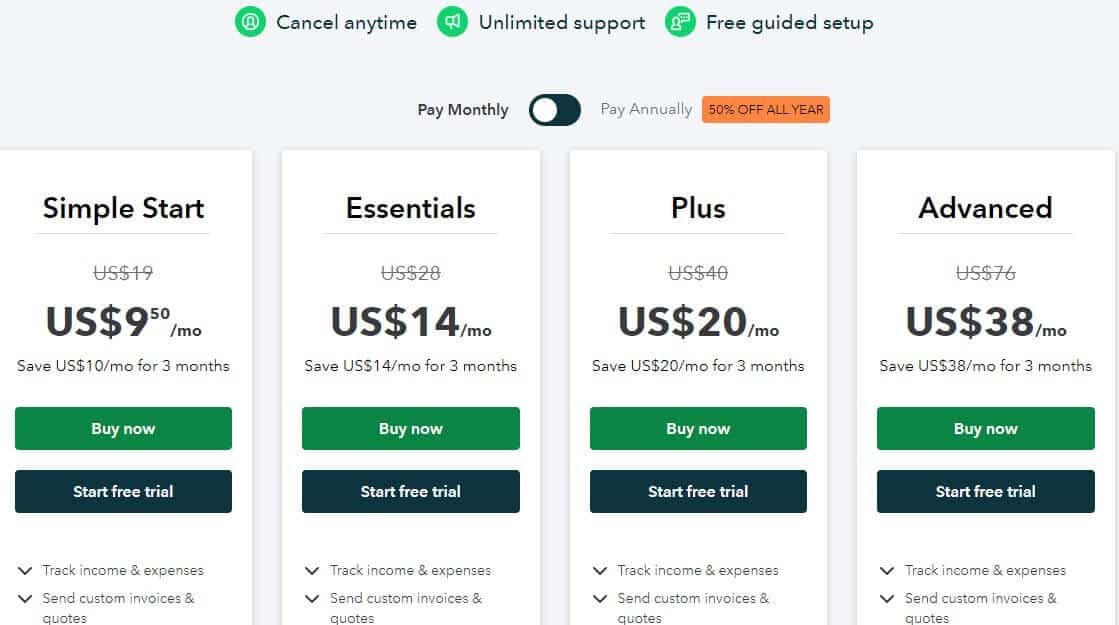

QuickBooks Pricing Structure

QuickBooks Online offers several pricing tiers to accommodate businesses of different sizes and needs. Each tier includes a specific set of features and comes with a monthly subscription fee.

- Simple Start: This is the most basic tier, suitable for small businesses with limited accounting needs. It includes features such as income and expense tracking, invoicing, and basic reporting.

- Essentials: This tier offers additional features, including inventory management, time tracking, and customer management. It is suitable for businesses that require more advanced functionality.

- Plus: This tier includes all the features in the Essentials tier, plus advanced reporting, project tracking, and the ability to track sales tax. It is suitable for businesses with more complex accounting needs.

- Advanced: This is the highest tier, offering the most comprehensive set of features, including advanced inventory management, employee expense tracking, and advanced reporting. It is suitable for large businesses with complex financial requirements.

Free trial:

QuickBooks offers a free 30-day trial for all of its plans, so you can try before you buy.

Verdict

Overall, QuickBooks Online is a powerful and versatile accounting software that can streamline financial management for businesses of all sizes. Its user-friendly interface, comprehensive features, and integration capabilities make it a valuable tool for improving efficiency and accuracy.

While QuickBooks Online may have some limitations, such as pricing and a learning curve for new users, its overall benefits often outweigh these drawbacks. If you are looking for a reliable and comprehensive accounting solution, QuickBooks Online is definitely worth considering.

FreshBooks

FreshBooks is a cloud-based accounting software primarily designed for freelancers, solopreneurs, and small businesses. It simplifies financial management by offering a user-friendly interface and a focus on invoicing and expense tracking. FreshBooks is known for its ease of use, making it accessible to those who may not have extensive accounting experience.

The platform operates on a subscription-based model, allowing users to access their accounts from anywhere with an internet connection. FreshBooks offers a range of features to help businesses manage their finances efficiently, including:

- Invoicing: Creating and sending professional invoices to clients, tracking payments, and accepting online payments.

- Expense tracking: Recording and categorizing expenses, including mileage and time tracking.

- Time tracking: Monitoring time spent on projects to accurately bill clients and track productivity.

- Project management: Basic project management tools to track tasks and deadlines.

- Reporting: Generating financial reports, such as income statements and profit and loss reports.

FreshBooks is particularly well-suited for businesses that need to send invoices and track expenses regularly. Its focus on simplicity and ease of use makes it a popular choice for freelancers and small businesses that want to avoid complex accounting software.

Features and Benefits

FreshBooks offers several features that can benefit small businesses and freelancers:

- Intuitive interface: The software is designed to be user-friendly, making it easy for users to navigate and perform tasks.

- Professional invoicing: FreshBooks provides customizable invoice templates, allowing businesses to create professional-looking invoices.

- Online payments: The software integrates with payment gateways, allowing businesses to accept payments directly from clients.

- Time tracking: Time tracking features help businesses accurately track the time spent on projects and bill clients accordingly.

- Expense tracking: FreshBooks makes it easy to record and categorize expenses, helping businesses stay organized and manage their finances effectively.

- Mobile app: The FreshBooks mobile app allows users to access their accounts and manage their finances on the go.

These features can help businesses save time, improve their financial accuracy, and simplify their accounting processes.

Pros and Cons

FreshBooks has its strengths and weaknesses, which should be considered when making a decision:

Pros

Cons

Is FreshBooks Right for You or Your Business?

FreshBooks is an excellent choice for freelancers, solopreneurs, and small businesses that need a simple and easy-to-use accounting solution. Its focus on invoicing and expense tracking makes it particularly suitable for businesses that need to manage their finances efficiently.

However, if your business has complex accounting needs or requires advanced features, FreshBooks may not be the best option. In such cases, it may be worth considering larger accounting software options with more comprehensive features.

Ultimately, the best way to determine if FreshBooks is right for you is to evaluate your specific needs and compare it to other available options. Consider factors such as pricing, features, scalability, and customer support when making your decision.

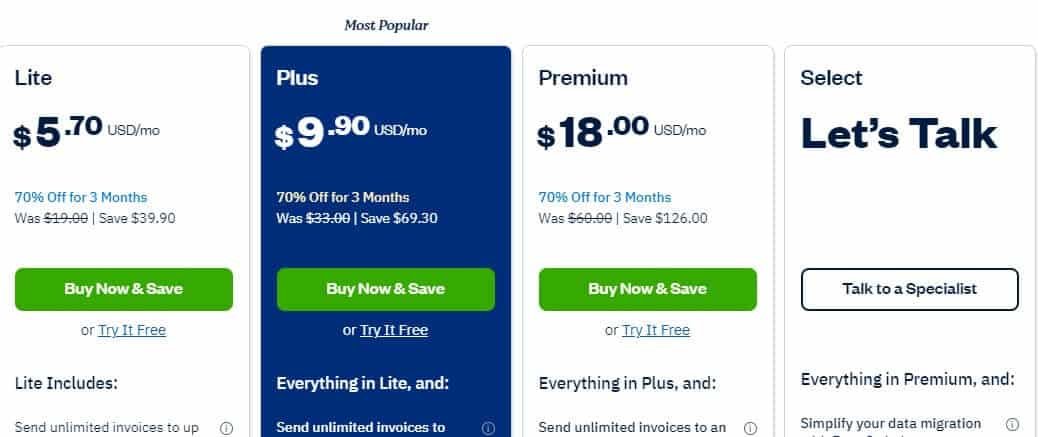

Pricing Structure

FreshBooks offers several pricing plans to accommodate businesses of different sizes and needs. Each plan includes a specific set of features and comes with a monthly subscription fee.

- Lite: The most basic plan, suitable for freelancers and small businesses with limited accounting needs.

- Plus: This plan offers additional features, such as time tracking, project management, and team collaboration.

- Premium: The highest tier plan, offering advanced features, including recurring invoices, expense reports, and custom branding.

The Premium plan includes everything in the Plus plan, plus project management tools, custom branding, advanced automation, priority support, and unlimited team members. Additionally, FreshBooks offers several add-on features, including Team Members, Advanced Payments, and FreshBooks Payroll.

Verdict

FreshBooks is a user-friendly and efficient accounting software that is well-suited for freelancers, solopreneurs, and small businesses. Its focus on invoicing and expense tracking, combined with its intuitive interface, makes it a valuable tool for managing finances.

FreshBooks is like a friendly accountant who keeps your finances in order without all the complicated jargon. While it might not be the best fit for massive corporations, it's perfect for small businesses and freelancers who just want to keep things simple. If you're looking for a tool that won't overwhelm you with numbers and spreadsheets, FreshBooks is a great choice.

Wave

Wave is a free online accounting software designed for small businesses and freelancers. It offers a comprehensive suite of tools to help manage finances, including invoicing, expense tracking, time tracking, and payroll. Wave is known for its user-friendly interface and free pricing model, making it an attractive option for businesses looking to simplify their accounting.

The platform operates on a freemium model, meaning users can access the basic features for free. However, for businesses that require more advanced features or want to accept credit card payments, there are additional fees associated with premium plans.

Key functionalities of Wave include:

- Invoicing: Creating and sending professional invoices to customers.

- Expense tracking: Recording and categorizing expenses, including mileage and time tracking.

- Time tracking: Monitoring time spent on projects to accurately bill clients.

- Payroll: Processing payroll, handling tax deductions, and issuing paychecks.

- Reporting: Generating financial reports, such as income statements and profit and loss reports.

Wave is well-suited for small businesses and freelancers who need a basic accounting solution without the high costs associated with traditional software. Its free pricing model and user-friendly interface make it a popular choice for those who are new to accounting or have limited budgets.

Features and Benefits

Wave offers a range of features that can benefit small businesses and freelancers:

- Free basic plan: The free plan includes essential features such as invoicing, expense tracking, and reporting.

- Easy to use: Wave is designed to be user-friendly, making it accessible to those with limited accounting experience.

- Time tracking: The time tracking feature helps businesses accurately track the time spent on projects and bill clients accordingly.

- Payroll: Wave's payroll feature simplifies the process of paying employees and handling tax deductions.

- Integration: Wave integrates with popular payment gateways and other business applications.

These features can help businesses save time, improve their financial accuracy, and simplify their accounting processes.

Pros and Cons

Wave has its strengths and weaknesses, which should be considered when making a decision:

Pros

Cons

Is Wave Right for You or Your Business?

Wave is a good option for small businesses and freelancers who need a basic accounting solution without the high costs associated with traditional software. Its free pricing model and user-friendly interface make it a suitable choice for those who are new to accounting or have limited budgets.

However, if your business has complex accounting needs or requires advanced features, Wave may not be the best option. In such cases, it may be worth considering larger accounting software options with more comprehensive features.

Ultimately, the best way to determine if Wave is right for you is to evaluate your specific needs and compare it to other available options. Consider factors such as pricing, features, scalability, and customer support when making your decision.

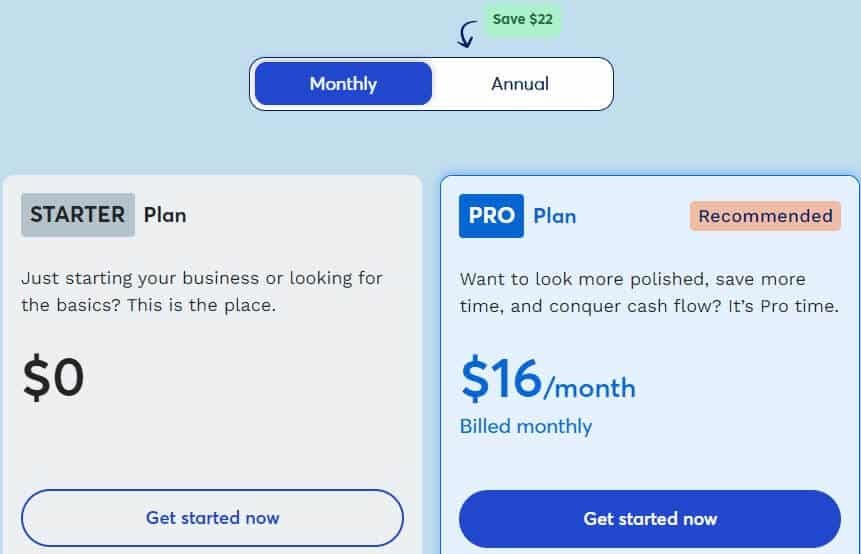

Wave Pricing Structure

Wave offers a freemium model, meaning the basic features are available for free. However, for businesses that require more advanced features or want to accept credit card payments, there are additional fees associated with premium plans.

- Free plan: The free plan includes essential features such as invoicing, expense tracking, and reporting.

- Premium plans: Wave offers several premium plans with additional features, such as payroll processing, credit card acceptance, and advanced reporting. The Pro Plan is available for a monthly fee of $16. By investing in the Pro Plan, you can enhance efficiency, improve decision-making, increase productivity, and receive personalized support

Verdict

Wave is a user-friendly and affordable accounting software that is well-suited for small businesses and freelancers. Its free basic plan and comprehensive features make it a valuable tool for managing finances.

While Wave may have limitations in terms of advanced features and additional fees for premium features, its simplicity and affordability make it a compelling option for those who need a basic accounting solution. If you are looking for a free and easy-to-use accounting software, Wave is definitely worth considering.

Zoho Books

Zoho Books is a cloud-based accounting software that brings simplicity and efficiency to managing your business finances. Whether you’re a small startup or a growing enterprise, Zoho Books has everything you need to keep your financial operations running smoothly.

Imagine effortlessly creating professional invoices and tracking their payments without a hitch. With Zoho Books, you can easily record and categorize every expense, from mileage to time-based costs, ensuring nothing slips through the cracks. You can also keep tabs on project time, so you’re billing accurately and making the most of your resources.

When it comes to payroll, Zoho Books takes the hassle out of managing salaries, tax deductions, and issuing paychecks. Plus, you’ll have access to detailed financial reports—like income statements, balance sheets, and cash flow statements—that offer clear insights into your business’s performance.

receive a $100 credit directly into your account! This credit can be applied to any Zoho service and will be valid for 60 days from the date of activation.

<<<<Get $100 Credit on Zoho!>>>

Features and Benefits

Zoho Books offers a robust set of features that can significantly enhance financial management efficiency and provide valuable insights into business performance. Some of the standout features include:

- Integration with Zoho suite: Zoho Books seamlessly integrates with other Zoho applications, such as Zoho CRM, Zoho Projects, and Zoho Inventory, creating a streamlined workflow.

- Automation: The software automates many routine accounting tasks, such as bank reconciliation and invoice generation, saving users time and reducing the risk of errors.

- Financial reporting: Zoho Books provides customizable financial reports that offer a clear and comprehensive view of a business's financial health. These reports can be used for decision-making, tax planning, and investor relations.

- Mobile access: The cloud-based nature of Zoho Books allows users to access their accounts and manage financial tasks from their smartphones or tablets, ensuring flexibility and convenience.

- Customer support: Zoho Books offers reliable customer support resources, including online help, tutorials, and live chat assistance, to help users get the most out of the software.

By leveraging these features, businesses can improve their financial accuracy, enhance productivity, and make data-driven decisions to support growth.

Pros and Cons

Zoho Books is a comprehensive accounting software with many strengths, but it's essential to weigh its benefits against potential drawbacks before making a decision.

Pros

Cons

Is Zoho Books Right for You or Your Business?

If you're already part of the Zoho family, Zoho Books is a natural fit. It seamlessly integrates with other Zoho applications, streamlining your workflow and saving you time.

Zoho Books is particularly well-suited for mid-sized businesses. It offers a comprehensive feature set that can handle everything from invoicing to inventory, without overwhelming you with unnecessary complexity.

Whether you're a service-based business, a manufacturer, or a retailer, Zoho Books has features designed specifically for your industry. From invoicing and expense tracking to inventory management and financial reporting, it's got you covered.

Before you make a decision, consider these factors:

- Cost-effectiveness: Compare pricing plans and features to find the best value.

- Feature-rich: Ensure the software offers the tools you need to streamline your operations.

- Scalability: Choose a solution that can grow with your business.

- Customer support: A reliable support team can make a big difference.

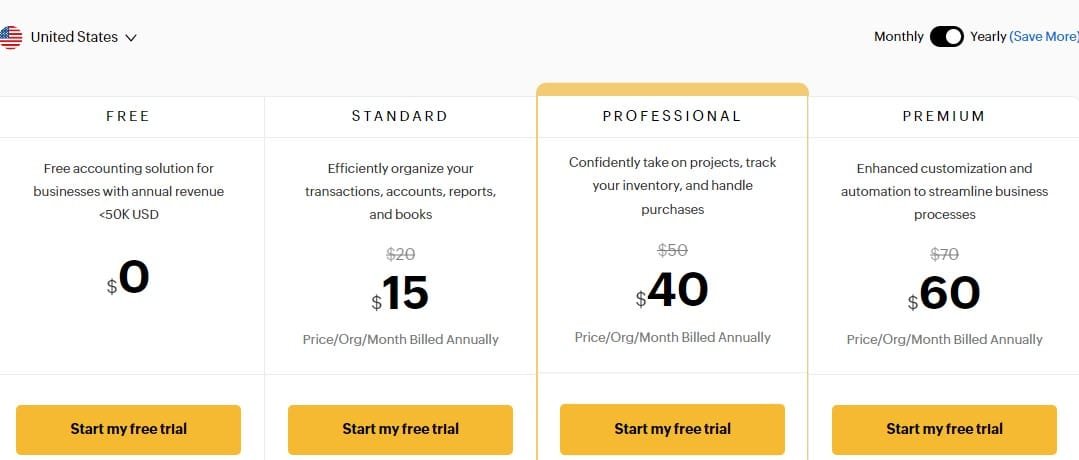

Zoho Books Pricing Structure

Zoho Books offers a variety of pricing plans to accommodate businesses of all sizes. Choose the plan that best suits your needs and efficiently manage your finances.

Free Plan: For small businesses with annual revenue under $50,000, Zoho Books offers a free plan with basic accounting features.

Standard Plan: Priced at $15/month (billed annually), this plan is ideal for businesses seeking organized transactions, accounts, and reports.

Professional Plan: For businesses requiring project management, inventory tracking, and purchase handling, the Professional Plan is available at $40/month (billed annually).

Premium Plan: Priced at $60/month (billed annually), this plan is suitable for businesses needing high-level customization and automation for tailored financial solutions.

Zoho Books offers flexible pricing plans tailored to suit businesses of all sizes, ensuring you have the right tools to manage your finances efficiently as your business grows. Choose the plan that best fits your needs and take control of your financial management today!

Verdict

Zoho Books is a handy tool for businesses of any size looking to streamline their finances. It seamlessly works with other Zoho apps and offers a wide range of features to boost efficiency and accuracy.

While it might take a bit of time to get used to, Zoho Books can save you a lot of hassle. Although it might not be the cheapest option out there, the benefits often outweigh the cost. If you're searching for a comprehensive accounting solution that plays well with other business tools, Zoho Books is definitely worth checking out.

HoneyBook

Tired of juggling multiple tools for your freelance business? HoneyBook is here to simplify your workflow. As a cloud-based platform, HoneyBook combines project management, invoicing, and payments into one easy-to-use solution.

Imagine keeping track of tasks, deadlines, and client communications in one place. HoneyBook's streamlined project management features make it a breeze. Plus, with its effortless invoicing and secure payments, you can create professional invoices quickly and easily, and get paid faster.

HoneyBook offers a range of features to help freelancers and creative professionals manage their projects and finances efficiently, including:

- Project management: Creating and managing projects, setting deadlines, and assigning tasks.

- Proposals: Creating and sending professional proposals to clients.

- Contracts: Generating and managing contracts with clients.

- Invoicing: Creating and sending invoices to clients, tracking payments, and accepting online payments.

- Payments: Accepting payments online through integrated payment gateways.

- Scheduling: Scheduling appointments and meetings with clients.

- Messaging: Communicating with clients directly within the platform.

Features and Benefits

HoneyBook offers a range of features that can benefit freelancers and creative professionals:

- Project management: The platform provides tools to manage projects effectively, including task management, deadlines, and progress tracking.

- Proposal and contract templates: HoneyBook offers pre-designed templates for proposals and contracts, saving users time and ensuring consistency.

- Online payments: The platform integrates with popular payment gateways, allowing freelancers to accept payments directly from clients.

- Scheduling: The scheduling feature helps freelancers and creative professionals coordinate appointments and meetings with clients.

- Messaging: The built-in messaging feature allows for direct communication with clients within the platform.

- Analytics: HoneyBook provides analytics tools to track project performance, client engagement, and financial data.

These features can help freelancers and creative professionals improve their productivity, streamline their workflow, and enhance their client relationships.

Pros and Cons

HoneyBook comes with both advantages and drawbacks, which are important to weigh when making a decision:

Pros

Cons

Is HoneyBook Right for You or Your Business?

HoneyBook is a powerful tool designed to simplify the lives of freelancers and creative professionals. Its intuitive interface and comprehensive features, including proposal generation, contract management, and online payments, make it an efficient platform for managing projects and finances. By streamlining administrative tasks, HoneyBook helps you stay organized, professional, and on top of your finances.

While HoneyBook is an excellent choice for many freelancers and creatives, larger businesses with complex needs may find that more specialized project management or accounting software better suits their requirements.

Before deciding on HoneyBook, take the time to really think about what your business needs and how it stacks up against other options. Consider things like pricing, features, scalability, and customer support to make sure you're picking the tool that truly aligns with your goals and helps your business thrive.

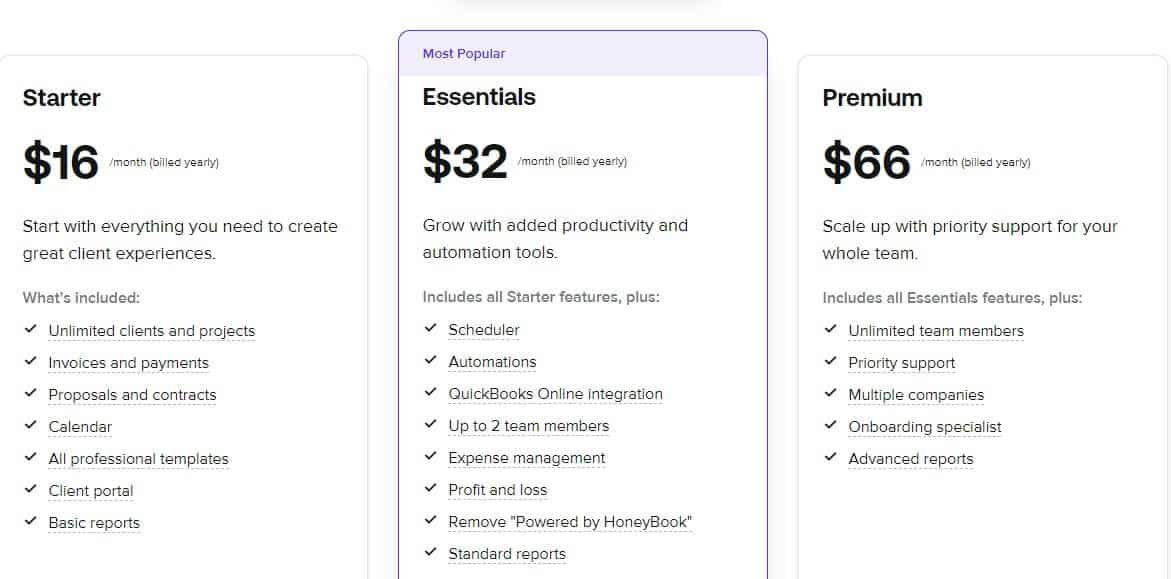

HoneyBook Pricing Structure

HoneyBook has a range of pricing plans designed to fit freelancers and creative professionals, no matter the size or needs of their business. Each plan offers its own set of features, all for a monthly subscription fee.

- Starter ($16/month when billed annually): The most basic plan, suitable for freelancers and small creative businesses.

- Plus ($32/month when billed annually): This plan offers additional features, such as team collaboration, advanced analytics, and custom branding.

- Premium ($66/month when billed annually): The highest tier plan, offering the most comprehensive set of features, including advanced project management, time tracking, and client onboarding tools.

It's important to note that HoneyBook may also offer seasonal promotions, discounts, or custom pricing plans for specific industries or use cases. To get the most accurate and up-to-date pricing information, it's recommended to visit HoneyBook's website

Verdict

HoneyBook is a user-friendly and efficient platform designed specifically for freelancers and creative professionals. Its focus on client experience, project management features, and online payments make it a valuable tool for streamlining workflows and improving client relationships.

While HoneyBook may have limitations in terms of pricing for larger businesses, its simplicity and ease of use make it a compelling option for freelancers and small creative businesses. If you are looking for a comprehensive platform to manage your projects and finances, HoneyBook is definitely worth considering.

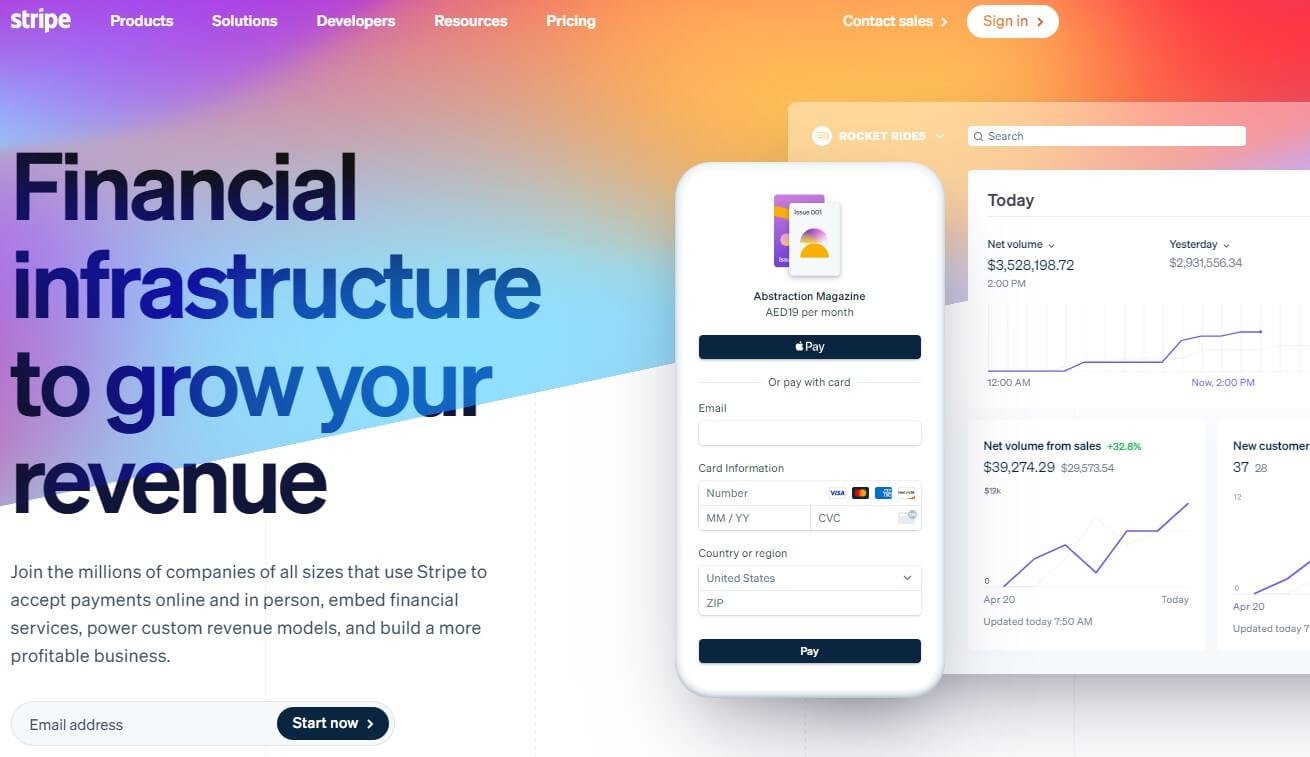

Stripe

Stripe is a leading digital payment platform that allows businesses to process online transactions globally. It provides developers with extensive APIs and tools to seamlessly incorporate payment features into their digital products. The service is recognized for its intuitive design, international accessibility, and advanced security measures.

Operating on a subscription model with transaction fees, Stripe supports diverse payment options like credit/debit cards and mobile wallets. The platform also offers comprehensive tools for payment management, dispute resolution, and fraud detection, making it a versatile solution for businesses of all sizes.

Key functionalities of Stripe include:

- Payment processing: Accepting payments from various sources, including credit cards, debit cards, and digital wallets.

- Customizable checkout: Creating custom checkout pages to match your brand and enhance the customer experience.

- Subscriptions: Managing recurring payments for subscription-based businesses.

- Invoices: Generating and sending invoices to customers.

- Fraud prevention: Using advanced tools to detect and prevent fraudulent transactions.

- Developer APIs: Providing APIs and SDKs for developers to integrate payment functionality into their applications.

Stripe is well-suited for businesses of all sizes that need to accept online payments. Its global reach, user-friendly interface, and robust features make it a popular choice for businesses looking to streamline their payment processing.

Features and Benefits

Stripe offers a range of features that can benefit businesses:

- Global reach: Stripe supports payments in over 100 countries and currencies, making it easy for businesses to expand their reach.

- Customizable checkout: Businesses can create custom checkout pages to match their brand and enhance the customer experience.

- Subscription management: Stripe provides tools for managing recurring payments, making it ideal for subscription-based businesses.

- Fraud prevention: Stripe uses advanced fraud detection tools to help protect businesses from fraudulent transactions.

- Developer-friendly: Stripe offers comprehensive APIs and SDKs, making it easy for developers to integrate payment functionality into their applications.

- Integration with other tools: Stripe integrates with popular e-commerce platforms, accounting software, and other business tools.

These features can help businesses improve their payment processing efficiency, reduce fraud, and enhance the customer experience.

Pros and Cons

Stripe has its strengths and weaknesses, which should be considered when making a decision:

Pros

Cons

Is Stripe Right for You or Your Business?

Stripe is a solid choice for businesses of all sizes looking to accept online payments. It’s easy to use, works globally, and offers plenty of features to help streamline payment processing.

That said, if you run a small business with fewer transactions, you might want to explore other payment options with lower fees. And if you’re not very tech-savvy, some of Stripe’s customization features could feel a bit limiting.

Ultimately, the best way to know if Stripe is right for you is to look at your business needs and compare it to other options. Pay attention to things like cost, features, scalability, and customer support when making your decision.

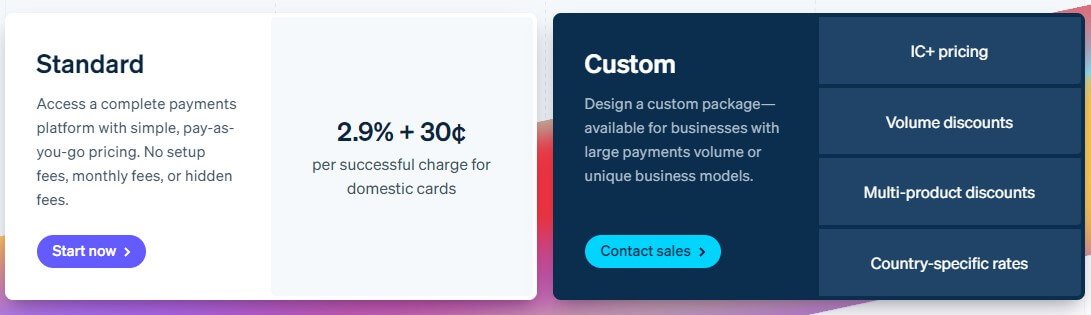

Pricing Structure

Stripe's pricing structure involves a combination of transaction fees and monthly fees. The exact fees vary depending on your location, transaction volume, and the specific features you use.

- Transaction fees: Stripe charges a percentage of each transaction, plus a fixed fee per transaction. The exact fees vary depending on your location and the type of payment.

- Monthly fees: Stripe may also charge monthly fees for certain features or plans.

Verdict

Stripe is a powerful and versatile payment processing platform that can benefit businesses of all sizes. Its global reach, customizable checkout, and robust fraud prevention measures make it a popular choice for businesses looking to streamline their payment processing.

While its pricing and customization options might be more complex for those without technical expertise, its reliability and efficiency often make it a worthwhile investment. If you prioritize a secure and streamlined payment experience, Stripe is definitely worth exploring

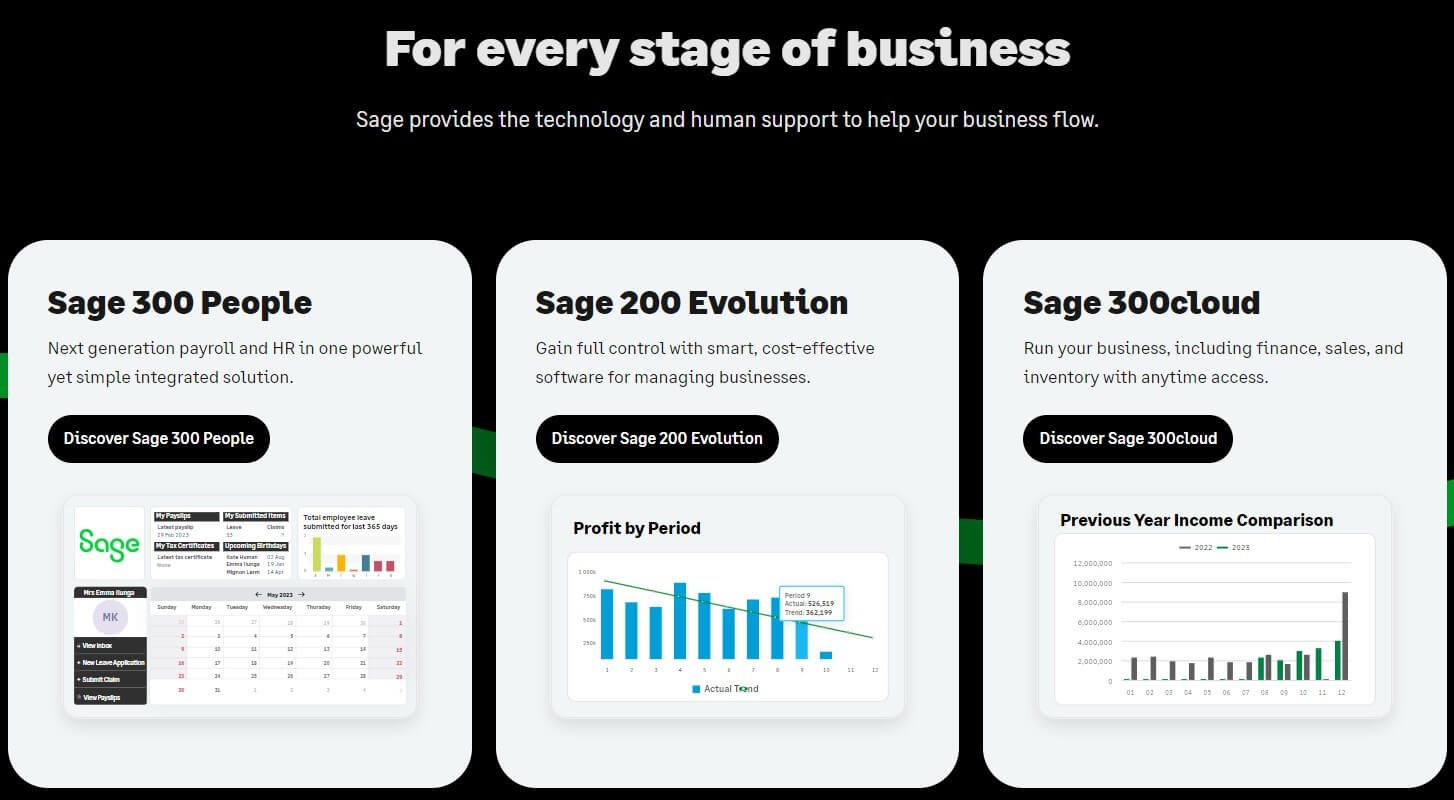

Sage

Sage is a powerful accounting software built to simplify financial management for businesses of all sizes. It comes with a wide range of tools and features that can adapt to different industries and business types. Sage is known for its strong capabilities, flexibility, and ability to integrate with other systems.

You can choose between Sage’s on-premise or cloud-based versions, depending on what works best for your business. The platform offers several modules to cover various needs, including:

- Accounting: Core accounting functions such as general ledger, accounts receivable, accounts payable, and financial reporting.

- Payroll: Payroll processing, tax management, and employee benefits administration.

- Inventory: Inventory management, stock tracking, and purchasing.

- CRM: Customer relationship management, including sales force automation and marketing automation.

- ERP: Enterprise resource planning, integrating various business processes for better efficiency.

Sage is well-suited for a wide range of businesses, from small startups to large enterprises. Its versatility and scalability make it adaptable to different business structures and growth stages.

Features and Benefits

Sage comes packed with features that can really boost how efficiently you manage your finances and give you helpful insights into how your business is doing. Some of its key features include:

- Comprehensive functionality: Sage offers a wide range of modules to cover various business needs, from accounting to CRM and ERP.

- Scalability: The software can accommodate businesses of different sizes and growth stages.

- Integration capabilities: Sage integrates seamlessly with other business applications, creating a streamlined workflow.

- Customization: The software can be customized to meet the specific needs of different industries and businesses.

- Financial reporting: Sage provides customizable financial reports that offer a clear and comprehensive view of a business's financial health.

- Mobile access: The cloud-based version of Sage allows users to access their accounts and manage financial tasks from their smartphones or tablets.

By leveraging these features, businesses can improve their financial accuracy, enhance productivity, and make data-driven decisions to support growth.

Pros and Cons

While Sage is a popular choice for accounting, it's crucial to evaluate its features and limitations to determine if it's the right fit for your specific needs

Pros

Cons

Is Sage Right for You or Your Business?

Choosing whether Sage is the right fit for your business depends on several factors, like how big your business is, what industry you're in, and the specific accounting tasks you need help with.

If you’re running a large business with complex accounting needs, Sage offers a solution that can grow with you. It’s packed with features and can integrate with other tools, making it ideal for companies managing a lot of different processes.

For mid-sized businesses, Sage is also a strong contender, especially if you need extras like inventory tracking, payroll, or detailed financial reports. But if you’re a smaller business with straightforward accounting needs, Sage might feel like too much and could be more than you’re willing to spend.

For businesses in industries like manufacturing, retail, or healthcare that need specialized features, Sage could be a great fit. They offer specific solutions tailored to these sectors.

At the end of the day, it’s about what your business needs. The best way to know if Sage is the right choice is to think through your specific requirements and compare them to other options. Look at the costs, features, scalability, and customer support to make the best decision for your situation.

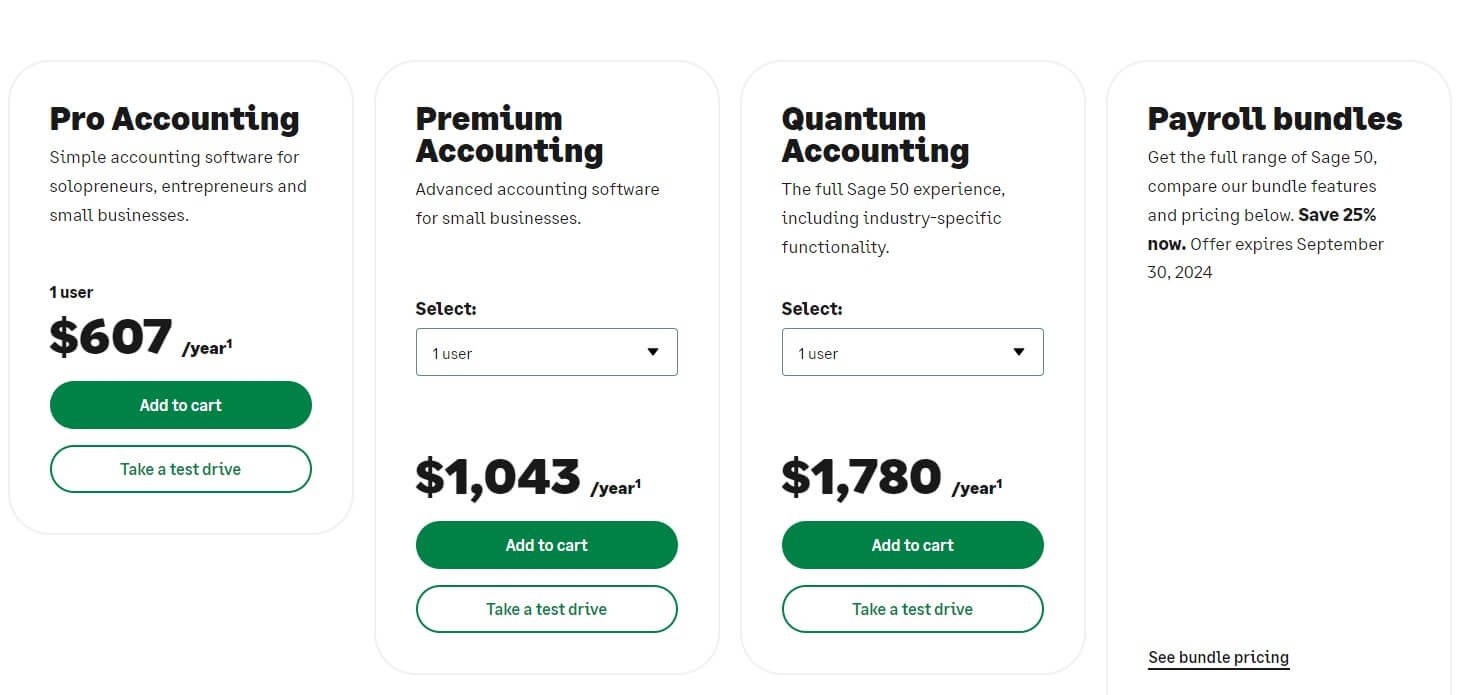

Pricing Structure

Sage offers a variety of pricing plans to accommodate businesses of different sizes and needs. The pricing can vary depending on the specific modules you require and your deployment option (on-premise or cloud-based).

There are three Sage subscription plans for Sage 50: Pro, Premium, and Quantum. The annual subscription for Pro is $607, Premium is $1,043, and Quantum is $1,780. Payroll is included with Pro for up to 30 employees for an additional $768.75, $1,095.75, and $1,522.75, respectively

Sage Verdict

Now, I'll be straight with you – Sage isn't exactly pocket change, and it might feel like overkill if you're just starting out. But trust me, once you get the hang of it, you'll wonder how you ever managed without it. If you're serious about taking your financial game to the next level, Sage could be your new best friend. Give it a whirl – your future self (and your accountant) will thank you!

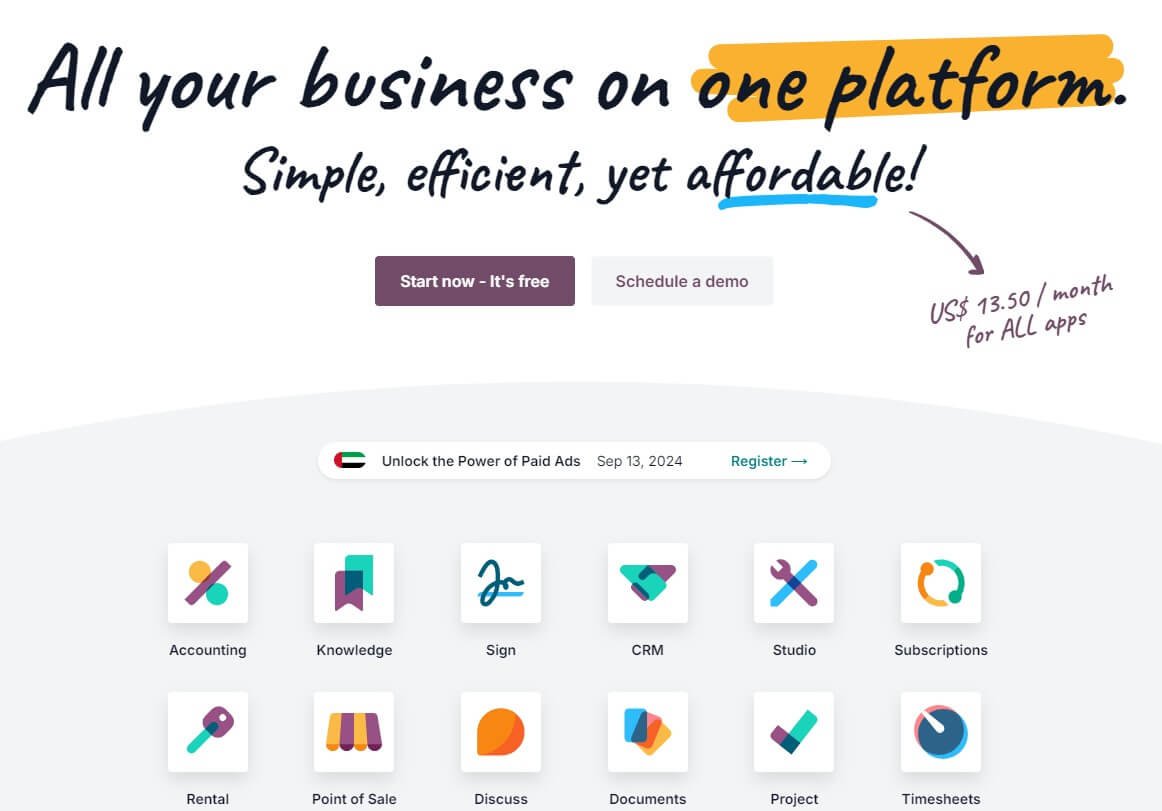

Odoo

Odoo is a comprehensive suite of business management applications that offers a wide range of features, including accounting, CRM, sales, marketing, inventory management, and more. Odoo is known for its modular design, which allows businesses to customize the software to their specific needs. It's also popular for its open-source nature, providing flexibility and control.

The platform operates on a freemium model, meaning users can access the basic features for free. However, for businesses that require more advanced features or want to access premium support, there are additional fees associated with paid plans.

Key functionalities of Odoo include:

- Accounting: General ledger, accounts receivable, accounts payable, and financial reporting.

- CRM: Customer relationship management, including sales force automation and marketing automation.

- Sales: Sales management, order processing, and quotations.

- Inventory: Inventory management, stock tracking, and purchasing.

- Manufacturing: Manufacturing management, including production planning and quality control.

- Project management: Project management tools to track tasks, deadlines, and resources.

- Website builder: A built-in website builder to create and manage your business website.

Odoo is well-suited for a wide range of businesses, from small startups to large enterprises. Its modular design and open-source nature make it adaptable to different business structures and growth stages.

Features and Benefits

Odoo offers a robust set of features that can significantly enhance business efficiency and provide valuable insights into performance. Some of the standout features include:

- Modular design: The software can be customized to meet the specific needs of different businesses by adding or removing modules.

- Open-source: Odoo is open-source, providing flexibility and control over the software.

- Integration capabilities: Odoo integrates seamlessly with other business applications, creating a streamlined workflow.

- Customization: The software can be customized to meet the specific needs of different industries and businesses.

- Financial reporting: Odoo provides customizable financial reports that offer a clear and comprehensive view of a business's financial health.

- Mobile access: The cloud-based version of Odoo allows users to access their accounts and manage business tasks from their smartphones or tablets.

By leveraging these features, businesses can improve their productivity, streamline processes, and make data-driven decisions to support growth.

Pros and Cons

While Odoo provides a comprehensive suite of business management features, it's crucial to evaluate its limitations and potential drawbacks to ensure it aligns with your specific needs

Pros

Cons

Is Odoo Right for You or Your Business?

Consider your specific business needs carefully. If you only require basic bookkeeping, Odoo's comprehensive approach might be overkill. On the other hand, if you need highly specialized features for your industry, you might find a dedicated solution more suitable.

Ultimately, the decision comes down to your business's unique requirements, resources, and future plans. It's worth taking the time to evaluate Odoo alongside other options, perhaps through a trial period, to see how well it aligns with your workflow and objectives. Remember, the right software should feel like a natural extension of your business, not a hurdle to overcome.

Pricing Structure

Odoo offers a freemium model, meaning the basic features are available for free. However, for businesses that require more advanced features or want to access premium support, there are additional fees associated with paid plans.

- Free plan: The free plan includes basic features such as CRM, sales, and project management.

- Paid plans: Odoo offers several paid plans with additional features, such as accounting, inventory management, and manufacturing. The pricing for these plans varies depending on your specific needs and location.

It's recommended to visit the Odoo website or contact their sales team for the most accurate pricing information.

Verdict

Odoo is a versatile business management platform that can help you streamline your operations. Its modular design lets you pick and choose the features you need, and being open-source means you have a lot of flexibility. While the free version might not have all the bells and whistles, Odoo's overall value makes it a great option for businesses looking for a customizable and scalable solution.

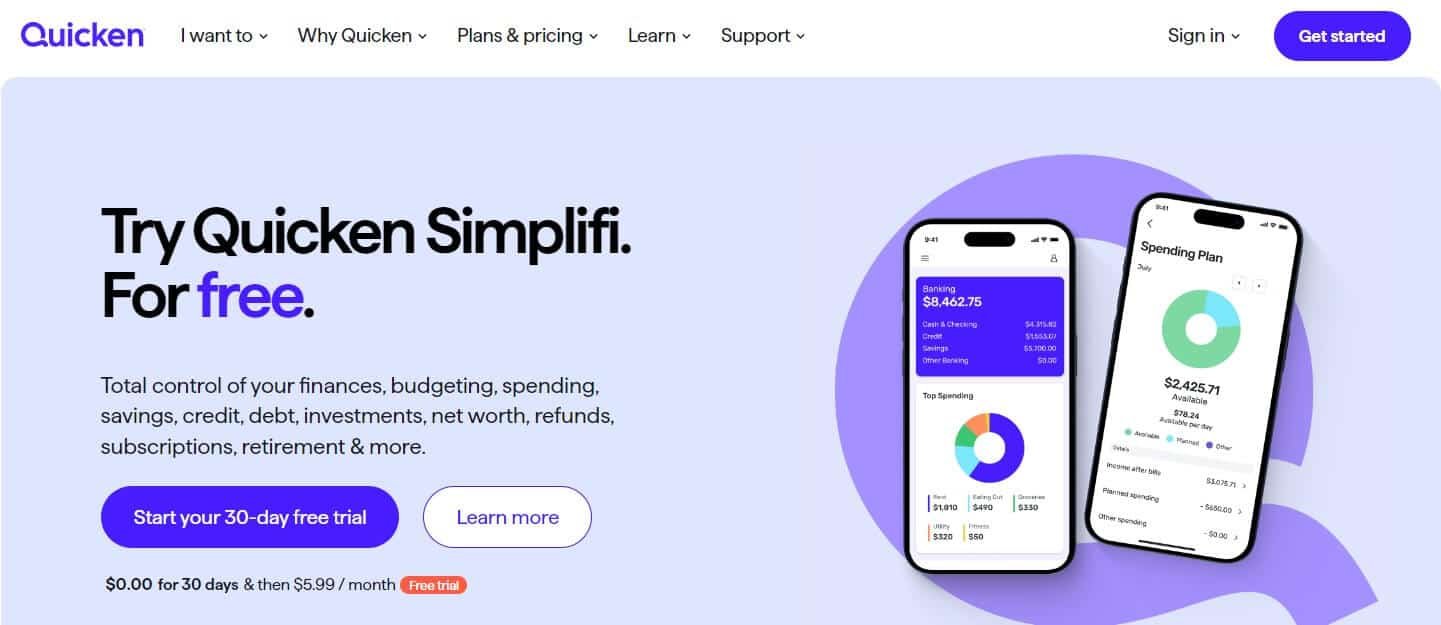

Quicken

Quicken is a personal finance software designed to help individuals and small businesses manage their finances effectively. It offers a range of features for tracking income, expenses, budgeting, and investing. Quicken is known for its user-friendly interface and comprehensive suite of tools.

The software is available in both desktop and cloud-based versions, allowing users to choose the option that best suits their needs. Quicken offers a variety of modules, including:

- Budgeting: Creating and tracking budgets for various categories, such as income, expenses, and savings.

- Banking and investing: Connecting to financial institutions to track bank accounts, credit cards, and investment portfolios.

- Bill payment: Paying bills online and scheduling automatic payments.

- Tax preparation: Assisting with tax preparation by organizing financial data.

- Financial planning: Tools for retirement planning, college savings, and debt management.

Quicken is well-suited for individuals and small businesses that need a comprehensive tool to manage their finances. Its user-friendly interface and range of features make it a popular choice for those who want to take control of their financial situation.

Features and Benefits

Quicken offers a robust set of features that can significantly enhance personal financial management. Some of the standout features include:

- Comprehensive budgeting: Quicken provides tools for creating and tracking budgets, helping users stay on top of their finances.

- Banking and investment tracking: The software can connect to financial institutions to track bank accounts, credit cards, and investment portfolios.

- Bill payment: Quicken simplifies bill payment by allowing users to pay bills online and schedule automatic payments.

- Tax preparation: The software can help organize financial data for tax preparation, saving users time and effort.

- Financial planning: Quicken offers tools for retirement planning, college savings, and debt management.

- Mobile access: The cloud-based version of Quicken allows users to access their accounts and manage their finances on the go.

By leveraging these features, individuals can improve their financial organization, make informed decisions, and achieve their financial goals.

Pros and Cons

Quicken can be a game-changer for managing your finances, but don't forget to consider its downsides to make an objective choice.

Pros

Cons

Is Quicken Right for You or Your Business?

Quicken is a great option if you need a personal finance tool with a lot of features. But it might be a bit pricey. If you're on a budget, there are free or cheaper alternatives out there. And if you just need something basic, a simpler app might be enough.

The best way to know if Quicken is right for you is to think about what you need and compare it to other options. Consider things like cost, features, how easy it is to use, and how helpful the customer service is.

Pricing Structure

Quicken's pricing varies depending on the specific plan and region. The Starter plan costs $47.88 annually or $4.99 monthly. The Deluxe plan costs $71.88 annually or $7.99 monthly. The Premier plan costs $95.88 annually or $9.99 monthly. The Home & Business plan costs $131.88 annually or $13.99 monthly.

Prices may vary depending on your location and any ongoing promotions. Quicken offers a 30-day free trial for all plans. You can choose to pay annually or monthly. There are discounts available for purchasing multiple-year subscriptions.

Note: Prices may change over time. It's recommended to visit the Quicken website for the most up-to-date pricing information:

Verdict

Quicken is a solid and flexible personal finance software that’s great for individuals and small business owners who want to stay on top of their finances.

With its wide range of features, an easy-to-use interface, and the ability to connect to many banks and financial institutions, it’s a handy tool for organizing your money and making smarter financial choices.

When it comes to pricing, Quicken is pretty reasonable for what you get. While there are cheaper options for people with simple financial needs, Quicken’s extra features—like tax prep and rental property management—make it worth the price if you’re looking for something more comprehensive.

NetSuite

NetSuite has been a game-changer for businesses of all sizes. As a cloud-based ERP system, it's like having a personal financial assistant, inventory manager, and customer relationship guru all rolled into one. From tracking your finances in real-time to keeping tabs on your inventory, NetSuite has got you covered.

What I love about NetSuite is its flexibility. It's like a chameleon, adapting to the unique needs of your business. Whether you're a small startup or a large corporation, NetSuite can grow with you. And let's not forget about its user-friendly interface. It's like having a personal accountant who speaks your language.

The platform operates on a subscription-based model, allowing users to access their accounts from anywhere with an internet connection. NetSuite offers a range of modules to cater to the diverse needs of different businesses, including:

- Accounting: General ledger, accounts receivable, accounts payable, and financial reporting.

- CRM: Customer relationship management, including sales force automation and marketing automation.

- ERP: Enterprise resource planning, integrating various business processes for better efficiency.

- E-commerce: Online store management, including product catalog, shopping cart, and order processing.

- Inventory: Inventory management, stock tracking, and purchasing.

- Manufacturing: Manufacturing management, including production planning and quality control.

- Project management: Project management tools to track tasks, deadlines, and resources.

NetSuite is well-suited for mid-sized and large enterprises that require a comprehensive and scalable business management solution. Its versatility and customization options make it adaptable to different industries and business structures.

Features and Benefits

NetSuite offers a robust set of features that can significantly enhance business efficiency and provide valuable insights into performance. Some of the standout features include:

- Comprehensive functionality: NetSuite offers a wide range of modules to cover various business needs, from accounting to CRM and ERP.

- Scalability: The software can accommodate businesses of different sizes and growth stages.

- Customization: NetSuite can be customized to meet the specific needs of different industries and businesses.

- Integration capabilities: The software integrates seamlessly with other business applications, creating a streamlined workflow.

- Financial reporting: NetSuite provides customizable financial reports that offer a clear and comprehensive view of a business's financial health.

- Mobile access: The cloud-based nature of NetSuite allows users to access their accounts and manage business tasks from their smartphones or tablets.

By leveraging these features, businesses can improve their productivity, streamline processes, and make data-driven decisions to support growth.

Pros and Cons

NetSuite is a fantastic tool for managing your business, but like any tool, it has its pros and cons.

Pros

Cons

Is NetSuite Right for You or Your Business?

NetSuite is a robust ERP system that excels at managing complex business operations. It's particularly well-suited for mid-sized to large enterprises, especially those in industries like retail, manufacturing, and distribution.

NetSuite's scalability makes it an excellent choice for businesses expecting to expand rapidly. Its multi-currency, multi-language, and tax support are invaluable for companies operating across borders. Additionally, NetSuite offers a wide range of features to streamline various business processes, providing comprehensive functionality.

However, it's important to note that NetSuite can be a significant investment, including the software itself, implementation, and ongoing support. Smaller businesses might find the system's features and complexity overwhelming, especially if they don't need all of its advanced capabilities.

Ultimately, if your business is growing rapidly, needs to manage complex operations, or has a global footprint, NetSuite could be a powerful tool. However, it's essential to carefully weigh the benefits against the costs to determine if it's the best fit for your specific needs. Smaller businesses might want to explore other ERP options that offer comparable functionality at a lower price point.

Pricing Structure

NetSuite's pricing model is typically tailored based on your business size, industry, and specific needs. Unlike fixed-price software, NetSuite offers customized quotes because it provides a highly configurable cloud-based ERP solution. However, you can expect the pricing to include the following key components:

1. License Cost

NetSuite operates on a subscription-based model where you pay annually or monthly, depending on your contract. The base license cost starts at around $999 per month for the platform, with an additional $99 per user per month for access to various modules.

2. Implementation Fees

Setting up NetSuite involves an initial implementation fee, which can vary significantly depending on the level of customization and the complexity of your business. This could range from $25,000 to $100,000 or more, depending on the scope and business size.

3. Additional Modules

NetSuite offers various add-on modules (such as CRM, eCommerce, inventory management, HR, etc.), and these come with their own fees. Businesses with specific needs like advanced financial management, supply chain management, or industry-specific features will incur additional costs. The pricing for these modules can range from $500 to $2,000 per month, depending on the functionality.

4. Support and Training

NetSuite offers support packages, which can increase the total cost. Standard support is included, but you can opt for premium support (24/7 assistance, faster response times), which is an added expense. Additionally, if your team needs training, there may be extra charges for onboarding and specialized training services.

Total Estimated Costs

For a small-to-medium-sized business with basic needs, the total cost for NetSuite could range from $25,000 to $50,000 annually. Larger enterprises with more users, advanced modules, and complex implementations could see costs well over $100,000 per year.

Factors That Influence Pricing:

- Number of Users – More users will increase your overall cost.

- Modules – The more modules you need, the higher the cost.

- Customization – Custom development, integrations, and workflow automation can increase both upfront and ongoing costs.

- Industry Requirements – Certain industries (e.g., retail, manufacturing) might require specialized modules, impacting pricing.

Verdict

Overall, NetSuite is a powerful and comprehensive business management suite that can streamline various aspects of your business operations. Its scalability, customization options, and integration capabilities make it a good choice for mid-sized and large enterprises.

While NetSuite may have limitations in terms of pricing and complexity for smaller businesses, its overall benefits often outweigh these drawbacks. If you are looking for a robust and scalable business management solution, NetSuite is definitely worth considering

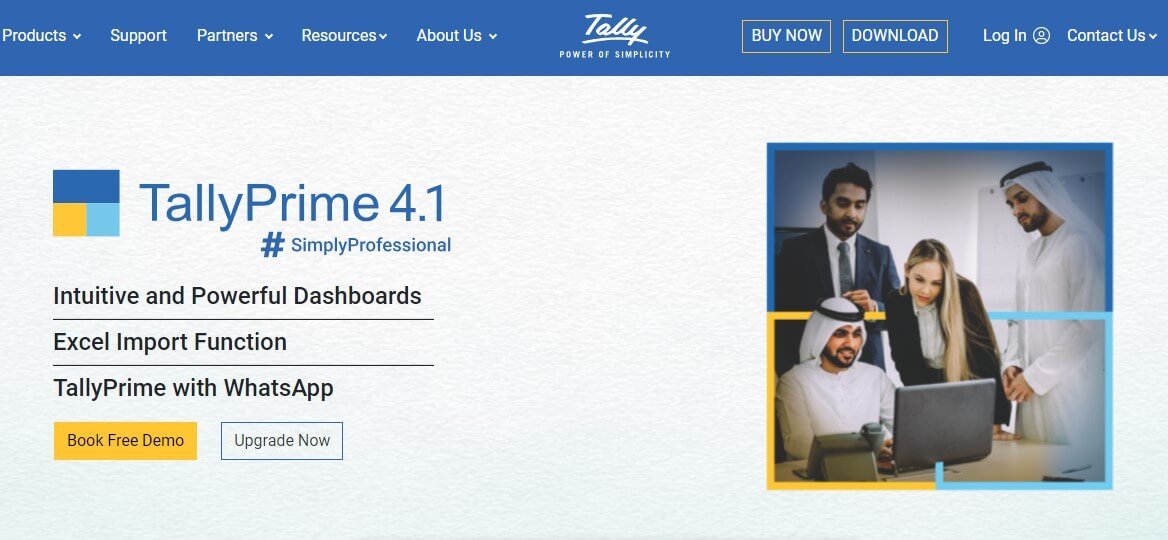

TallySolutions

TallySolutions is a popular accounting software widely used in India and other parts of the world. It offers a comprehensive suite of features for financial management, inventory control, and payroll processing. TallySolutions is known for its robustness, customization options, and focus on Indian accounting standards.

The software is available in both on-premise and cloud-based versions, allowing businesses to choose the deployment option that best suits their needs. TallySolutions offers a range of modules, including:

- Accounting: General ledger, accounts receivable, accounts payable, and financial reporting.

- Inventory: Inventory management, stock tracking, and purchasing.

- Payroll: Payroll processing, tax management, and employee benefits administration.

- Sales and purchase: Sales and purchase management, including invoicing and order processing.

- Costing: Costing of products and services.

- Banking: Integration with banks for automatic bank reconciliation.

TallySolutions is well-suited for businesses of all sizes, from small startups to large enterprises. Its versatility and customization options make it adaptable to different industries and business structures.

Features and Benefits

TallySolutions offers a robust set of features that can significantly enhance financial management efficiency and provide valuable insights into business performance. Some of the standout features include:

- Comprehensive functionality: TallySolutions offers a wide range of modules to cover various business needs.

- Customization options: The software can be customized to meet the specific needs of different industries and businesses.

- Integration capabilities: TallySolutions integrates with other business applications, creating a streamlined workflow.

- Financial reporting: The software provides customizable financial reports that offer a clear and comprehensive view of a business's financial health.

- Mobile access: The cloud-based version of TallySolutions allows users to access their accounts and manage business tasks from their smartphones or tablets.

- Indian accounting standards: TallySolutions is designed to comply with Indian accounting standards, making it a popular choice for Indian businesses.

By leveraging these features, businesses can improve their financial accuracy, enhance productivity, and make data-driven decisions to support growth.

Pros and Cons

TallySolutions is like a Swiss Army Knife for your finances – packed with features, versatile, and always ready to help. But before you decide to add it to your toolkit, let's explore its blades and see if it's the perfect match for your accounting needs.

Pros

Cons

Is TallySolutions Right for You or Your Business?

Whether Tally is right for you or your business depends on several factors, including the size of your business, your specific accounting needs, and how you manage your financial data.

TallySolutions is an affordable, user-friendly accounting and ERP software ideal for small and medium businesses (SMBs), especially in India due to its GST compliance and local tax support. It offers essential features like real-time financial reporting, inventory tracking, and multi-currency support.

However, it lacks extensive customization and is not cloud-native, making it less suited for larger enterprises or businesses with complex needs. If you need a simple, cost-effective accounting tool, Tally is a strong choice, but larger businesses may require more advanced solutions like NetSuite or SAP.

Pricing Structure

Tally offers flexible pricing options, including perpetual licenses and subscription-based plans. The pricing varies depending on the specific features and modules required.

Note: Prices are approximate conversions based on the exchange rate at this time of writing.

Single-user edition for standalone PCs (perpetual):

- Silver: $650

- Gold: $1,950

Development environment for Tally Definition Language (per year):

- Silver: $370

- Gold: $925

For medium and large enterprises (TallyPrime Server works with TallyPrime Gold license):

- TallyPrime Server: $9,750

Verdict

Overall, TallySolutions is a powerful and versatile accounting software that can streamline financial management for businesses in India. Its comprehensive functionality, customization options, and focus on Indian accounting standards make it a popular choice.

While TallySolutions may have limitations in terms of complexity and international focus, its overall benefits often outweigh these drawbacks. If you are a business operating in India and looking for a robust accounting solution, TallySolutions is definitely worth considering.

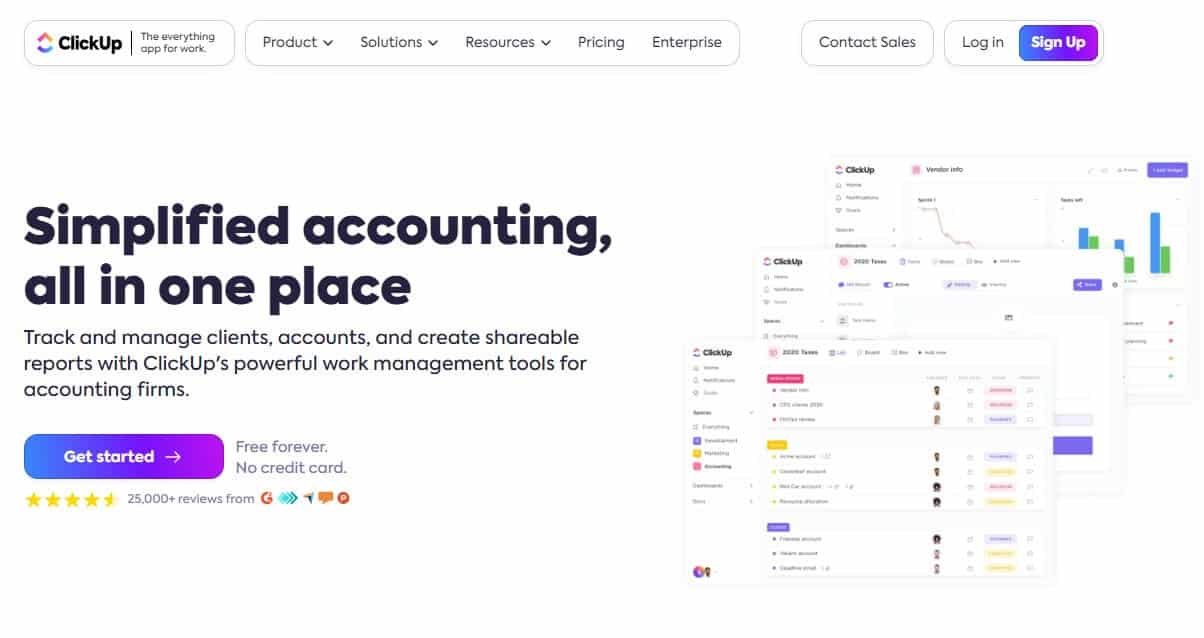

ClickUp Accounting.

ClickUp Accounting is a relatively new and integrated feature within the popular project management and collaboration tool, ClickUp. It aims to provide a simplified and streamlined accounting solution for businesses, especially those already using ClickUp for project management.

While not as comprehensive as traditional standalone accounting software, ClickUp Accounting offers essential features like:

- Invoicing: Creating and sending professional invoices to clients.

- Expense tracking: Recording and categorizing expenses.

- Payment processing: Accepting payments directly through the platform.

- Financial reporting: Generating basic financial reports, such as income statements and profit and loss statements.

ClickUp Accounting is designed to be user-friendly and seamlessly integrate with the rest of the ClickUp platform, making it a convenient option for businesses that are already familiar with ClickUp.

Features and Benefits

- Integration with ClickUp: The primary benefit of ClickUp Accounting is its seamless integration with the ClickUp platform, allowing for a unified workspace.

- Simplified invoicing: The invoicing feature is designed to be easy to use, with customizable templates and automated calculations.

- Expense tracking: Businesses can track expenses directly within ClickUp, making it easier to manage finances.

- Payment processing: ClickUp Accounting offers basic payment processing capabilities, allowing businesses to accept payments from clients.

- Financial reporting: While not as comprehensive as standalone accounting software, ClickUp Accounting provides basic financial reports to help businesses track their financial performance.

Pros and Cons

Pros

Cons

Is ClickUp Accounting Right for You or Your Business?

ClickUp Accounting is a good option for businesses that are already using ClickUp for project management and need a simplified accounting solution. It is particularly suitable for small businesses or freelancers who require basic invoicing, expense tracking, and financial reporting capabilities.

However, if your business has complex accounting needs, such as inventory management, payroll processing, or advanced financial reporting, a standalone accounting software may be a better fit.

Ultimately, the best way to determine if ClickUp Accounting is right for you is to evaluate your specific needs and compare it to other available options. Consider factors such as the features offered, integration with your existing workflow, and your overall budget.

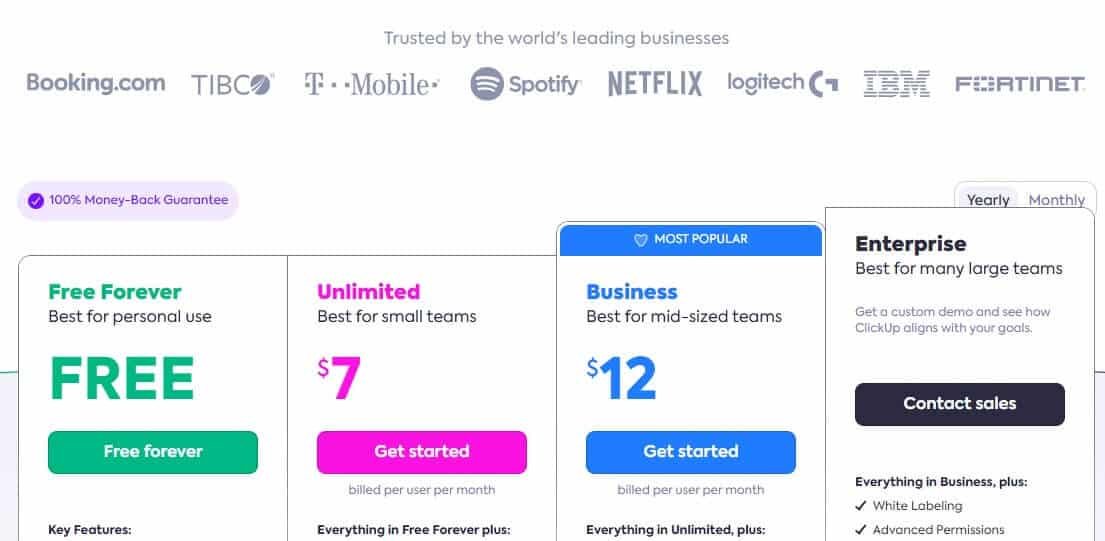

ClickUp Accounting Pricing

ClickUp doesn't have a specific "Accounting" pricing plan. However, its general pricing structure is as follows:

Free Plan:

- Unlimited members

- 100MB storage

- Limited task management features

Business Plan:

- $5 per user per month (billed annually)

- Unlimited storage

- Advanced task management features

- Integrations

- Time tracking

Enterprise Plan:

- Custom pricing

- All features of the Business plan, plus additional features tailored to large organizations

While ClickUp doesn't have dedicated accounting features, it can be used for various accounting tasks like tracking expenses, managing invoices, and collaborating with accounting teams. You might need to explore third-party integrations or customize ClickUp to fully meet your accounting needs.

Microsoft Dynamics 365 Finance & Operations

Key Features and Benefits

Financial Management.

Operations Management

Streamlining your business operations. Think of Dynamics 365 as a conductor orchestrating your business's daily activities. It helps you manage inventory, plan production, and ensure quality control. By optimizing these processes, you can improve efficiency, reduce costs, and deliver products or services on time.

Supply Chain Management

A smooth-running supply chain. Dynamics 365 is the master of logistics, ensuring that your products flow seamlessly from suppliers to customers. It helps you find the right suppliers, manage relationships with vendors, and optimize transportation. With tools for demand planning, you can anticipate customer needs and avoid stockouts or overstocking.

Integration

A connected ecosystem for better decision-making. Dynamics 365 is like a bridge connecting different parts of your business. It allows information to flow freely between your financial, operational, and sales systems, providing a more complete and accurate picture. This helps you make informed decisions and improve overall efficiency.

Pros and Cons

Pros

Cons

Is Dynamics 365 Finance & Operations Right for You?

Dynamics 365 Finance & Operations is well-suited for organizations that require a comprehensive ERP solution to manage their financial, operational, and supply chain processes. It is particularly beneficial for businesses that are already heavily invested in Microsoft technologies and want a unified platform for their operations.

However, smaller businesses or those with simpler requirements may find the software to be overkill and expensive. In such cases, other ERP solutions or cloud-based accounting software might be more suitable.

Pricing Structure

The pricing for Dynamics 365 Finance & Operations is based on a subscription model. The exact cost will depend on several factors, including the number of users, the modules implemented, and any additional services required. Microsoft offers various licensing options and pricing plans to accommodate different business needs.

Verdict

Microsoft Dynamics 365 Finance & Operations is a powerful ERP solution that can help organizations streamline their operations and improve efficiency. Its comprehensive functionality, scalability, and integration capabilities make it a strong contender for businesses seeking a robust and flexible platform. However, potential users should carefully evaluate their needs and budget to determine if it is the right fit for their organization.

TrulySmall Accounting

TrulySmall Accounting is a cloud-based accounting software designed specifically for small businesses and freelancers. It offers a simplified approach to financial management, focusing on the core features essential for most small businesses. The platform is known for its ease of use and affordability, making it a popular choice for those who don't require complex accounting functionalities.

Features and Benefits

TrulySmall Accounting offers a range of features to help small businesses manage their finances efficiently:

- Income and Expense Tracking: Easily record and categorize income and expenses.

- Invoicing and Billing: Create professional invoices and track payments.

- Bank and Credit Card Integration: Connect your bank and credit card accounts for automatic reconciliation.

- Reporting: Generate basic financial reports, such as profit and loss statements and balance sheets.

- Tax Preparation: Prepare simple tax returns using the software's built-in tools.

While TrulySmall Accounting may not have as many advanced features as some larger accounting software options, it provides a solid foundation for small businesses to manage their finances effectively.

Pros and Cons

Pros

Cons

Is TrulySmall Accounting Right for You or Your Business?

TrulySmall Accounting is a good fit for small businesses and freelancers who:

- Need a simple and affordable accounting solution.

- Don't require complex features like inventory management or advanced reporting.

- Prefer a user-friendly interface that is easy to learn.

- Are looking for a cost-effective way to manage their finances.

However, if your business has more complex accounting needs or requires advanced features, you may need to consider a more robust accounting software option.

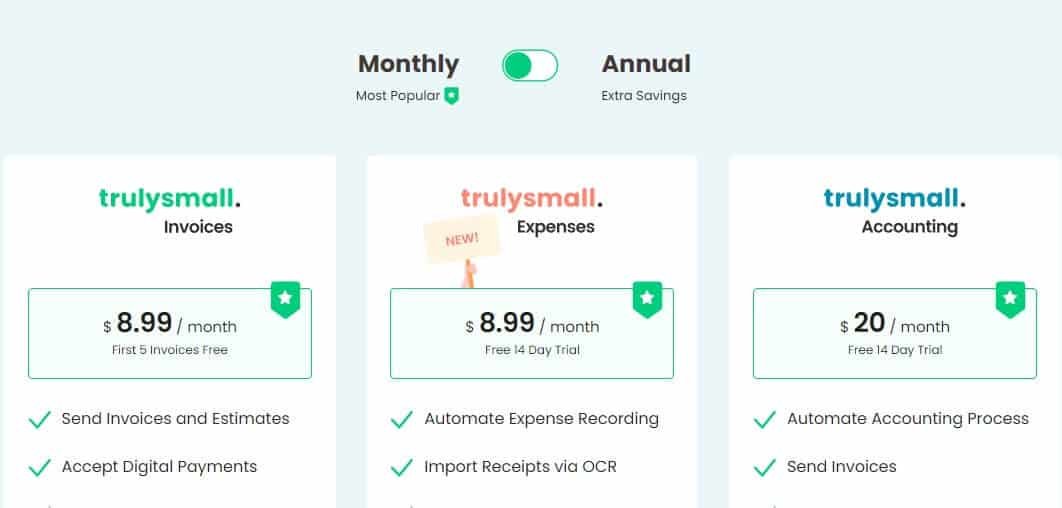

TrulySmall Accounting Pricing Structure

TrulySmall Accounting offers a flexible pricing structure that caters to the needs of small businesses and freelancers. While they don't publicly disclose their exact pricing plans on their website, here's what you can expect:

- Most Popular Plan: $8.99/month

- Annual Plan with Extra Savings: $8.99/month (discounted)

- Invoicing Plan: $8.99/month

- Expense Tracking Plan: $8.99/month

- Accounting Plan: $20/month

Verdict

TrulySmall Accounting is a reliable and budget-friendly option for small businesses and freelancers in need of a straightforward accounting solution. Its user-friendly interface and essential features make it easy to manage finances without the complexities of larger software.

While it may lack some advanced functionalities, it effectively caters to the basic accounting needs of most small enterprises. If you're seeking a cost-effective and efficient way to track income, expenses, and generate financial reports, TrulySmall Accounting is a solid choice to consider.

Patriot Software Accounting

Patriot Software Accounting is a cloud-based accounting software designed to cater to the needs of small businesses and entrepreneurs. It offers a variety of features to help businesses manage their finances, including income and expense tracking, invoicing, payroll, and reporting. Patriot is known for its user-friendly interface and affordable pricing, making it a popular choice for small businesses.

Features and Benefits

Patriot Software Accounting offers a comprehensive set of features, including:

- Income and Expense Tracking: Easily record and categorize income and expenses.

- Invoicing and Billing: Create professional invoices and track payments.

- Payroll Processing: Manage payroll, calculate taxes, and generate paychecks.

- Inventory Management: Track inventory levels, costs, and sales.

- Reporting: Generate customizable reports to gain insights into financial performance.

- Bank and Credit Card Integration: Connect your bank and credit card accounts for automatic reconciliation.

- Time Tracking: Track employee hours and project time to accurately calculate labor costs and billing.

These features can help businesses streamline their financial operations and make informed decisions.

Pros and Cons

Pros

Cons

Is Patriot Software Accounting Right for You or Your Business?

Patriot Software Accounting is a good fit for small businesses and entrepreneurs who:

- Need a comprehensive accounting solution at an affordable price.

- Value a user-friendly interface and easy-to-use features.

- Want to streamline their financial operations and improve efficiency.

- Need to manage payroll, inventory, or time tracking.