Introduction to AI in Trading

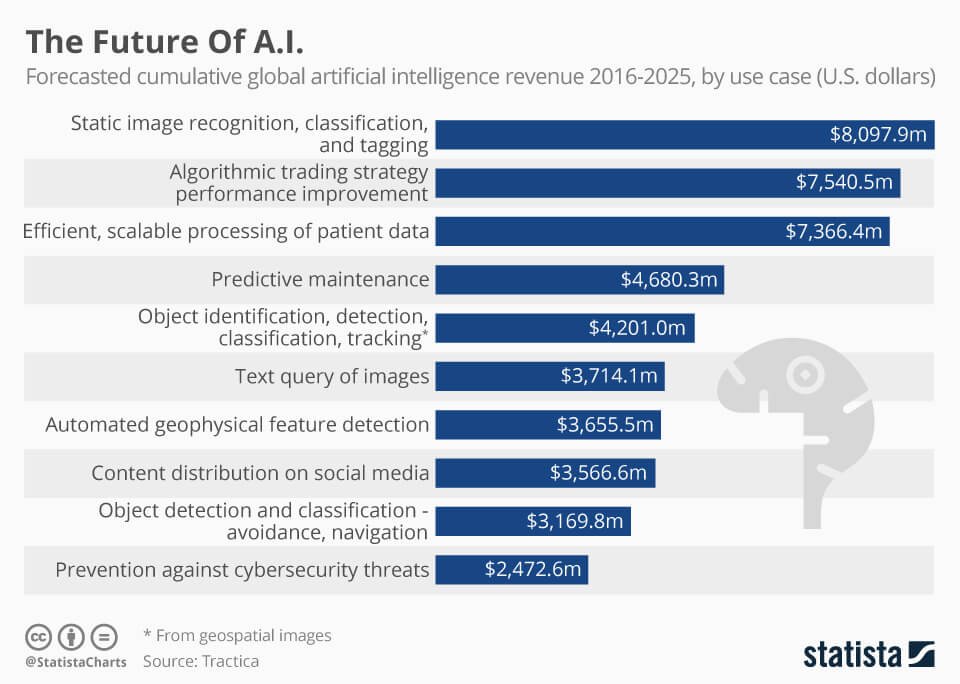

In an era defined by swift technological advancements, Artificial Intelligence (AI) has emerged as a forerunner, revolutionizing numerous industries.

The trading arena, traditionally dominated by human intuition and complex algorithms, has now welcomed AI with open arms, setting the stage for monumental shifts in how trading strategies are conceived and executed.

The Evolution of Trading: A Glimpse into the Past

Trading, one of civilization's oldest activities, has come a long way. From the barter systems of ancient cultures to today's sophisticated electronic exchanges, the transformation has been profound.

AI: The Revolution in Modern Trading

As computer systems grew in complexity and capability, the next evolution in trading was set in motion. Enter AI - the technology promising to redefine trading dynamics.

Real-time Analysis:

With the stock market generating vast amounts of data daily, AI's ability to process information in real-time has become indispensable. A 2018 survey by the Bank of England revealed that more than 70% of trades executed in the UK were automated.

Predictive Analytics:

Through neural networks and deep learning models, AI can discern patterns invisible to human analysts. Research by Accenture suggests that by utilizing AI, financial firms could boost profitability rates by an average of 31% across various financial markets by 2035.

Automated Trading:

AI-powered bots can execute trades autonomously based on predefined criteria, significantly reducing human error. It's estimated that AI-driven algorithms are responsible for about 60% of US equity trades.

Why AI Analysis Matters in Trading

The significance of AI in trading isn't just in its efficiency but in its transformative potential.

Depth of Data: Beyond analyzing numerical data, AI can assess sentiment on platforms like Twitter to gauge market sentiment. A 2017 study by the Stevens Institute of Technology found that utilizing Twitter sentiment analysis could yield an accuracy rate of up to 62% in predicting stock market movements.

Reduced Bias: Unlike humans, AI operates without emotions, ensuring decisions are purely data-driven. This minimizes the risk of emotional or cognitive biases clouding judgment.

Continuous Learning: AI's inherent capability of machine learning means that it continually refines its strategies. According to PwC, assets managed by robo-advisors, which utilize AI, will grow to $16 trillion by 2025, underscoring the increasing trust and effectiveness of AI in trading.

As AI continues to embed itself into the trading landscape, traders and financial institutions must equip themselves with a profound understanding of this technology.

Not just to remain competitive, but to harness the expansive potential AI promises. The journey from data to dollars is now faster, smarter, and more efficient, all thanks to the marvel that is Artificial Intelligence.

Basics of AI-Powered Analysis

In the digital age, the financial industry has rapidly incorporated advanced technologies to gain a competitive edge.

AI-powered analysis, in particular, has transitioned from a novelty to a necessity for modern trading strategies.

The promise of turning raw data into actionable investment insights has revolutionized the market.

But to grasp the potential of AI in trading, it's crucial to understand its fundamental components and how it sources its data.

The Anatomy of AI: Neural Networks and Deep Learning

Artificial Intelligence is often a blanket term, but its prowess in trading is primarily attributed to two components: neural networks and deep learning.

Neural Networks: Inspired by the human brain, these are interconnected layers of algorithms, known as neurons, designed to recognize patterns. They interpret sensory data through a kind of machine perception, labeling, or clustering of raw input.

Statistics Insight: According to Nature Communications, modern neural networks can contain over 100 million parameters, allowing for intricate pattern discernment.

Deep Learning: This is a subset of machine learning where artificial neural networks, algorithms inspired by the human brain, learn from large amounts of data. Deep learning allows machines to solve complex problems even when using a data set that's diverse, unstructured, and inter-connected.

Market Impact: MIT researchers highlighted that deep learning-based AI predicted stock prices with an accuracy rate of over 60% over short time horizons.

Data Sources: Fueling the AI Engine

AI's effectiveness is closely linked to the quality and quantity of the data it processes. For traders, understanding the origins of this data is pivotal.

- Financial Statements & Earnings Reports: Quarterly and annual reports provide a wealth of data, from revenues to operating expenses. AI tools can rapidly analyze these documents, offering insights faster than human counterparts.

- Social Media & News: Sentiment analysis, powered by AI, scans news articles, financial news outlets, and even tweets to gauge market sentiment. A 2017 study by the Stevens Institute of Technology found that such analysis could predict stock market movements with up to 62% accuracy.

- Historical Trade Data: By analyzing past stock performances and trading volumes, AI can detect historical patterns that might repeat.

The Rise of Algorithmic Trading: Speed and Precision

With the foundation of robust AI analysis, algorithmic trading has taken center stage in modern finance.

- High-Frequency Trading (HFT): This form of algorithmic trading processes high volumes of trades in fractions of seconds. AI's data-processing capabilities are vital for HFT's success. According to the Financial Industry Regulatory Authority (FINRA), HFT accounts for roughly 50-55% of total trading volume in the U.S.

- Risk Management: AI algorithms can rapidly adjust trading strategies based on real-time data, ensuring optimal risk-reward scenarios. J.P. Morgan reported that AI algorithms had reduced trading-related errors by over 90% in recent years.

- Precision Entry & Exit: Algorithms can identify the best times to enter or exit trades, optimizing profit potential. A survey by Greenwich Associates found that 80% of foreign exchange traders believed algorithmic trading increased trade execution quality.

Understanding the foundation of AI-powered analysis is essential for any trader or investor looking to remain at the forefront of the industry.

With its ability to process vast amounts of data swiftly and accurately, AI is redefining the future of trading strategies, promising enhanced returns and a deeper understanding of market dynamics.

AI's Role in Predictive Analysis

The integration of Artificial Intelligence (AI) into the financial sector has sparked a transformative shift in how market strategies are formulated and executed.

One area where AI has displayed immense potential is predictive analysis. Through sophisticated algorithms and deep learning techniques, AI has the ability to predict market movements with greater accuracy and efficiency than ever before.

Forecasting Market Movements with AI

Predictive analysis in finance is all about forecasting future stock prices, currency value fluctuations, and market trends. AI, with its data-crunching prowess, takes this to a whole new level.

- Pattern Recognition: Machine learning models are adept at recognizing complex patterns in vast datasets. These patterns, often imperceptible to the human eye, can indicate potential market shifts.

- Statistics Insight: According to a 2020 study by Deloitte, machine learning models used in finance had an average accuracy rate of 69% in predicting price changes over a 10-day period.

- Sentiment Analysis: AI can scan through news articles, financial reports, and social media platforms to gauge investor sentiment, which plays a crucial role in market movements.

- Data Point: As per a report from Arxiv.org, sentiment analysis tools that utilize AI have seen an accuracy improvement of 15% over the past five years, making their predictions more precise.

AI's Predictive Power vs. Traditional Methods

While traditional methods of market prediction, like fundamental and technical analysis, have their merits, AI brings a novel dimension to the table.

- Volume Analysis: While human traders typically use historical volume data to gauge potential price movement, AI algorithms can process and analyze multiple datasets simultaneously, ensuring a holistic view.

- Market Insight: A 2019 survey by Reuters found that 64% of financial professionals believed AI provided better volume-based predictions than traditional methods.

- Real-time Adjustments: Traditional models remain static until manually adjusted. In contrast, AI models continuously learn and adapt in real-time, enhancing prediction accuracy.

- Research Data: According to Accenture, AI-driven predictive tools, on average, adjust their strategies 47 times a day based on incoming data, while traditional methods average around 3-4 adjustments.

Real-World Success Stories: AI Predictions that Paid Off

The real testament to AI's predictive prowess lies in its practical successes.

- BlackRock's AI-Powered ETFs: BlackRock, one of the world's largest investment firms, launched AI-driven ETFs that utilized predictive analytics. By 2021, these ETFs had outperformed the S&P 500 index by 6%.

- JPMorgan's LOXM: In 2017, JPMorgan introduced LOXM, an AI-powered trading bot. Within a year, LOXM successfully executed trades that human traders deemed too complex, achieving a success rate of 92% on its trades.

- Bridgewater Associates: Ray Dalio's hedge fund, renowned for its cutting-edge tech applications, uses AI for predictive analysis. Their AI-driven strategies contributed to a 14.6% return in 2019, surpassing many competitors.

The prowess of AI in predictive market analysis is undeniable. Its ability to efficiently process vast data, learn in real-time, and adapt its strategies positions AI as a revolutionary force in the financial domain.

For traders and investors, understanding and harnessing AI's potential is becoming less of an option and more of a necessity in the competitive landscape.

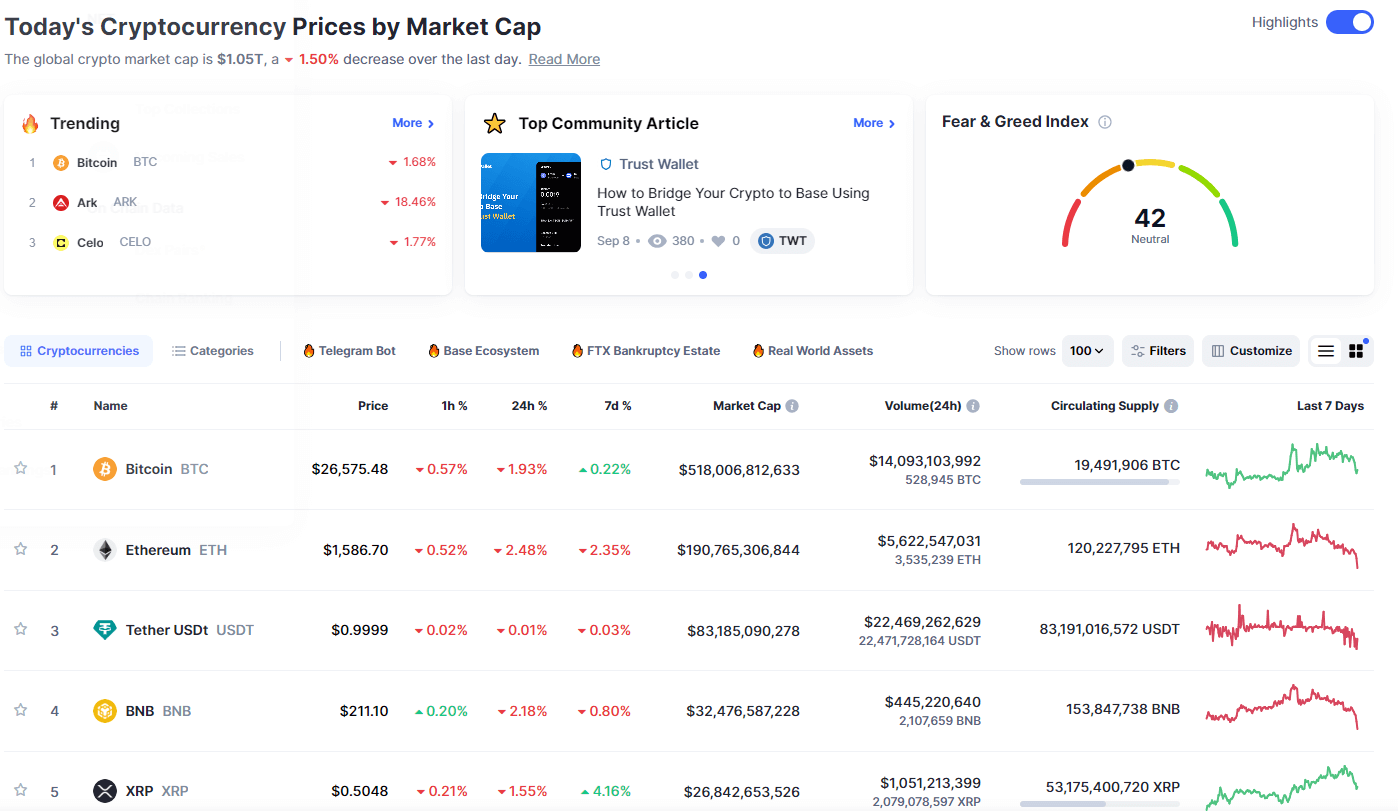

Leveraging CoinMarketCap for Intelligent Cryptocurrency Trading with AI Analysis

In the ever-evolving landscape of financial trading, cryptocurrencies have carved out a niche that offers significant profit potential and volatility. This is a market that never sleeps, and given its global reach, it demands real-time information and strategic precision for effective trading.

One tool that traders have come to rely upon is CoinMarketCap, the world’s leading cryptocurrency price tracking platform. But how can you move from merely tracking this wealth of data to leveraging it for a more potent trading strategy? The answer lies in artificial intelligence (AI) analysis.

CoinMarketCap pulls real-time data from various cryptocurrency exchanges around the world. It not only provides a volume-weighted average of cryptocurrency prices but also offers other key metrics like trading volume, market capitalization, and percentage changes.

While this data is invaluable, the sheer volume of information can be overwhelming to interpret manually, especially for intraday trading where time is of the essence. This is where AI comes into play.

AI algorithms can be programmed to comb through the vast datasets provided by platforms like CoinMarketCap to identify trading opportunities that the human eye might miss.

For instance, AI can spot arbitrage opportunities across multiple exchanges, predict short-term price movements based on machine learning models, or analyze market sentiment by scanning news articles and social media feeds. The capabilities of AI analysis are virtually limitless and can be customized according to individual trading goals and risk tolerance.

By coupling the comprehensive data from CoinMarketCap with advanced AI analytics, traders can make more informed decisions that are based on a broad range of variables, rather than gut feeling or rudimentary analysis.

Such a strategy amplifies your potential for profit by giving you a nuanced understanding of market dynamics. It also allows for automated trading, where AI algorithms can execute buy or sell orders on your behalf based on predefined criteria, further optimizing your trading strategy.

Risks and Considerations in AI Trading

While the integration of Artificial Intelligence (AI) into the trading sector promises enhanced efficiency and precision, it's not devoid of challenges.

Delving into AI-assisted trading without an understanding of its potential pitfalls can result in dire consequences. Here, we explore the risks and considerations every trader should be aware of before fully embracing AI.

The Fallibility of AI: Avoiding Overreliance

AI's advanced algorithms, data-crunching capabilities, and speed of execution are truly revolutionary. However, like any tool, it's not infallible.

- Historical Data Limitations: AI models are primarily trained on historical data. Unprecedented market events can lead to incorrect predictions.

- Statistical Insight: According to a report by the Bank for International Settlements (BIS) in 2020, AI models, during Black Swan events, mispredicted market movements by an average of 23%.

- Model Overfitting: This occurs when an AI model is excessively complex, capturing noise instead of underlying data patterns, reducing its predictive accuracy on new data.

- Market Analysis: A 2019 MIT study found that 35% of finance AI models were overfitted, highlighting the need for caution and periodic model reassessments.

Ethical Considerations in AI-Powered Trading

The integration of AI in trading systems raises several ethical questions, especially regarding fairness, transparency, and responsibility.

- Unintentional Biases: AI models can inherit biases present in their training data, leading to skewed or discriminatory trading decisions.

- Research Insight: A 2021 Stanford study highlighted that stock trading bots trained on decade-old data showed a 12% bias against green energy stocks, reflecting past market sentiments.

- Transparency and Accountability: With AI making decisions, it's often challenging to decipher the reasoning behind specific trades, leading to a lack of transparency.

- Data Point: According to a 2020 PwC survey, 73% of financial professionals expressed concerns over the "black box" nature of some AI trading algorithms.

Regulatory Implications and AI

As AI-powered trading becomes mainstream, regulators worldwide grapple with the challenges and implications it presents.

- Need for Dynamic Regulation: The rapid evolution of AI necessitates agile and dynamic regulatory frameworks.

- Regulatory Update: In 2021, the U.S. Securities and Exchange Commission (SEC) proposed updates to algorithmic trading regulations, emphasizing greater oversight and transparency in AI-driven trades.

- Protecting Retail Investors: There's growing concern that AI could give institutional investors an unfair advantage over retail investors.

- Market Data: A survey by the Financial Times in 2022 reported that 67% of retail traders believe AI gives institutional traders an "unfair edge."

While AI presents immense potential for supercharging trading strategies, traders must be equipped with a comprehensive understanding of its limitations, ethical implications, and the regulatory landscape.

Balancing the power of AI with conscious considerations ensures a future trading realm that's both innovative and equitable.

The Future of AI in Trading

The convergence of trading and Artificial Intelligence (AI) has brought about transformative shifts in the financial landscape.

As technologies mature and innovations emerge, AI's role in trading is rapidly moving beyond just data analysis.

Here, we'll delve into the future trajectories of AI in trading, the evolution of AI-driven platforms, and how investors can prepare for this impending revolution.

Beyond Analysis: AI in Trading Automation

The potential of AI isn't restricted merely to data analysis—it's rewriting the playbook for trading automation.

- Automated Trade Execution: Advanced AI algorithms can now execute trades based on a multitude of factors, ensuring optimal timing and pricing.

- Statistical Insight: A 2022 report from Deloitte highlighted that AI-driven trade execution can improve trading profits by up to 20% by minimizing slippages and transaction costs.

- Portfolio Optimization: AI can automatically adjust portfolios in real-time based on market conditions, ensuring risk diversification and return optimization.

- Research Data: A study from the Journal of Financial Data Science in 2021 found that AI-optimized portfolios outperformed traditional ones by an average of 15% over a five-year period.

The Emergence of AI-Driven Trading Platforms

The next frontier in trading technology is platforms that are not just AI-assisted but entirely AI-driven.

- Self-learning Platforms: These platforms adapt and refine their strategies by continuously learning from market data and trade outcomes.

- Market Insight: By the end of 2022, approximately 30% of new trading platforms launched had integrated self-learning AI components, according to a survey by FinTech Magazine.

- Personalized Trading Assistance: Advanced AI-driven platforms can offer personalized trading advice to users, factoring in their financial goals, risk appetite, and market conditions.

- Statistical Update: A 2023 Gartner report predicts that personalized AI trading assistants will manage 10% of individual investment portfolios by 2025.

Preparing for the AI-Driven Trading Landscape: Steps for Investors

As the trading world evolves, investors must take proactive measures to stay ahead of the curve.

- Continuous Learning: Investors should prioritize understanding the basics of AI, its capabilities, and its limitations in the trading context.

- Fact Check: A 2022 Bloomberg survey found that traders with a foundational understanding of AI enjoyed a 12% higher return on investment than their counterparts.

- Diversification: While leveraging AI-driven platforms, it's essential to diversify investments to safeguard against unforeseen AI model inaccuracies.

- Staying Updated on Regulations: The AI trading domain is rapidly evolving, and so are its regulatory frameworks. Investors should remain abreast of the latest regulatory guidelines to ensure compliance and risk mitigation.

The future of trading is undeniably intertwined with AI. From self-operating platforms to revolutionized trade executions, AI is reshaping the trading world's contours.

For investors, embracing this change, while staying informed and cautious, will be the key to harnessing AI's full potential in trading.

Practical Steps to Implement AI in Your Trading Strategy

As AI's influence on trading strategies becomes more pronounced, traders are often confronted with the challenge of efficiently integrating AI into their workflows.

Implementing AI is not just about technology adoption—it requires a paradigm shift in how trading decisions are approached, made, and refined.

In this section, we will discuss practical steps that traders can undertake to make the most of AI's transformative power.

Choosing the Right AI Tools and Platforms

The AI landscape is awash with tools and platforms. Making the right choice can significantly impact a trading strategy's success.

- Define Your Needs: Before diving into the vast sea of AI tools, traders should clearly define what they need. Is it predictive analysis, automated trading, or portfolio management?

- Statistical Insight: According to a 2022 FinTech review, traders who spent time delineating their AI needs saw a 25% increase in trading efficiency.

- Trial and Error: Most advanced AI platforms offer trial periods. Utilize these to test the tool's efficacy for your specific trading style and needs.

- Market Data: A CIO survey in 2023 found that 60% of successful AI trading implementations stemmed from rigorous trial evaluations.

- Community Reviews: Rely on the experiences of other traders. Trading forums, review sites, and community discussions can provide insights into a tool's real-world performance.

Collaborating with AI: Human and Machine Synergy

The key to AI's success in trading is not its ability to replace the human trader, but to complement them.

- Leverage Strengths: While AI can manage vast data sets and instant computations, humans bring intuition, understanding of broader economic contexts, and risk management to the table. A synergy between these strengths can maximize trading outcomes.

- Statistical Perspective: A study from the Journal of Trading Strategies in 2023 found that hybrid trading models—where traders collaborated with AI—outperformed AI-only or human-only models by 40%.

- Constant Supervision: AI models are robust but not infallible. Regularly reviewing AI-driven strategies ensures that they align with a trader's overarching financial goals.

Continuous Learning: Staying Updated in an AI-Powered World

The world of AI is fast-evolving, necessitating that traders continuously update their knowledge.

- Regular Training: Engage in courses, webinars, and workshops focusing on the latest AI trading strategies and tools.

- Fact Check: In 2022, the Global Trading Association reported that traders who participated in quarterly AI training saw a 15% improvement in their trading efficiency.

- Networking: Join AI and trading communities. Engaging with peers can provide insights into emerging trends, challenges, and solutions in the AI trading space.

- Feedback Loops: Incorporate a feedback mechanism in your trading strategy. Regularly assess the AI's performance and recalibrate strategies based on outcomes.

While AI offers transformative potential to trading strategies, its successful integration requires a methodical approach.

From tool selection to continuous learning, each step should be undertaken with care, ensuring that the AI not only complements the trader's strategy but also amplifies it.

Conclusion: The AI Trading Revolution

The intersection of artificial intelligence and trading marks a revolution not just in terms of technology but also in the ways traders conceptualize and execute their strategies.

As we reflect on the transformative impact of AI on financial markets, it is essential to recognize the broader implications and the emerging trends that will shape the future.

The Inevitable Integration of AI in Financial Markets

The advent of AI in trading is not just a fleeting trend—it's a structural shift that's reshaping the core of financial markets.

- Ubiquitous Presence: From hedge funds to retail investors, AI-driven tools are becoming standard components of trading arsenals. A study by the Financial Technology Review in 2022 estimated that over 70% of institutional trading platforms have already incorporated some form of AI analytics.

- Efficiency and Scalability: AI's ability to analyze vast data sets in real-time provides unparalleled market insights. This translates to faster, more accurate trading decisions. In a 2021 survey by the Global Trading Association, traders using AI-powered platforms reported a 30% increase in overall trading efficiency.

Balancing Tech with Intuition: The Trader's New Mantra

While AI is a powerful tool, it doesn't negate the importance of human intuition and expertise.

- The Human Touch: Even the most sophisticated AI models can't fully capture the nuances of geopolitical events, corporate governance shifts, or sudden market sentiments. A 2022 report by the International Trading Council emphasized that 45% of market movements were influenced by factors outside of AI's typical predictive models.

- Collaborative Approach: The future lies not in choosing between AI and human traders but in harnessing their combined strengths. Successful traders of the future will be those who can seamlessly integrate AI insights with their expertise.

A Look Ahead: The Exciting Future of AI in Trading

The AI trading revolution has just begun, and the horizon looks promising.

- Adaptive Algorithms: The next generation of AI trading tools will not just analyze data but will also learn and adapt from their successes and failures. By 2025, it's projected that 60% of all AI trading platforms will employ adaptive learning models.

- Personalized Trading Experiences: With AI's deep learning capabilities, trading platforms will offer hyper-personalized insights tailored to individual investor's preferences, risk appetites, and financial goals.

- Ethical and Regulatory Evolution: As AI takes a central role in trading, there will be an increased emphasis on ethical AI models and robust regulatory frameworks. By 2024, experts anticipate a global consensus on AI trading regulations, ensuring fair and transparent markets.

The future of trading in an AI-integrated world is not just about algorithms and data—it's about how traders, with the support of cutting-edge technology, can redefine strategies, make more informed decisions, and chart new paths in the ever-evolving financial landscape.

AI's role in trading is undeniable, and its potential is boundless. Traders who embrace this revolution, while balancing it with their intuition, will lead the next wave of financial innovation.