Are you trying to put the finances of your business in order? and this is what we will discover in this FreshBooks Review .

We will take a look at an online accounting software, which could be the remedy for your problems.

Certainly, for small businesses and entrepreneurs looking to manage their accounts and track their bills, it can be tricky to choose the right solution.

Neglecting to send an invoice because of bad accounting is a disastrous mistake for a business. Not getting paid, especially when you start, is not an option.

To help make a wise decision, we have written this review including FreshBooks pros and cons. ( PS. this review is based on our personal use of Freshbooks )

Cloud Accounting Software

Trial: 30 days

Starts from: $5.70 per month

Freshbooks coupon

All FreshBooks plans are 50% off for the first 6 months when new users skip the 30 day free trial period.

Recap of FreshBooks Free benefits:

- FreshBooks has everything you and/or your accountant need to stay organized year-round and be 100% ready for tax season

- You can create and send super polished invoices in about 30 seconds with FreshBooks

- FreshBooks keeps you organized with smart and simple time tracking for you and your team

- FreshBooks lets you record and organize expenses with a tap of your mobile camera

- FreshBooks gets you paid in a snap by accepting credit card payments directly on invoices

- For faster payment next time, you can save credit card info directly in client profiles

What is Freshbooks?

FreshBooks is a cloud accounting software, focusing on time management, invoicing solution, billing, and expense tracking.

The service also offers other useful features, such as financial reporting and synchronization to quickly invoice customers and get paid faster.

In Short : FreshBooks is a reliable and secure accounting kit that transforms complicated financial management into a pleasant activity.

Why you need FreshBooks ?

Are you tired of juggling multiple spreadsheets and feeling overwhelmed by your finances? FreshBooks is here to simplify your accounting and give you back your time. As a cloud-based accounting software designed specifically for small businesses, FreshBooks offers a user-friendly interface and powerful features that can streamline your operations.

One of the key benefits of FreshBooks is its ability to automate many of the time-consuming tasks associated with accounting. From automatic invoice generation and payment reminders to expense tracking and reporting, FreshBooks takes care of the tedious details so you can focus on growing your business.

In addition to its automation capabilities, FreshBooks also provides valuable insights into your financial health. With easy-to-understand reports and dashboards, you can track your income, expenses, and cash flow in real time. This information can help you make informed decisions about your business and identify areas for improvement.

Whether you're a freelancer, a small business owner, or a team of professionals, FreshBooks has the tools you need to manage your finances effectively. With its intuitive interface, powerful features, and commitment to customer satisfaction, FreshBooks is the ideal accounting solution for businesses of all sizes.

Who can use Freshbooks

Freshbooks is one of the most successful online accounting tools with thousands of paying customers.

Unlike other business accounting softwares, Freshbooks was built for small businesses and freelancers from the ground up.

This makes it ideal for entrepreneurs who want something sweet in features, yet straightforward to use.

What's included in Freshbooks?

FreshBooks has added many features lately, all intended to make your life more comfortable. These include :

Invoicing

Once you fix up your business profile and a record of your service with pricing, you can begin producing invoices.

The software is easy to use. You can build and send a brand-new invoice in just a couple of minutes, depending on how fast you type.

The freshbooks app provide you further benefits like personalizing the style of the invoice, adding your logo, and producing the invoice recurring if you do the same task every month for that customer.

You can also opt for the currency for the invoice, doing it easy to do business internationally.

You can also set reminders, informing you if the payment is delayed, and can add a late fee if a client's payment is late. with Freshbooks you can :

Expenses

With the newest version of FreshBooks, It's easy to manage your expenses. Link your company bank accounts, including any business credit accounts, and the software automatically imports your activities to run from one point.

Additionally, You can categorize your expenses as they occur, and FreshBooks will identify the rules you placed for the upcoming transactions.

You can also show customers a project’s expense receipts and project development in the customer portal. We like how you can have everything arranged, even if transactions are made from different accounts.

Other Expense FreshBooks features :

Project

An added great highlight of the late version of FreshBooks is the ability to trace and manage the whole projects.

FreshBooks allows you to build a place where team members and customers can see and share files, chat, and cooperate on a project. On the software you can:

Payments

FreshBooks makes it comfortable to accept payments from anywhere in the world from clients right from within the invoice.

They can pay using credit cards, Stripe, PayPal, or Apple Pay.

Signing up to take credit card payments into FreshBooks is Free and is made via WePay.

You are required to confirm your account and connect your bank in 14 days.

Link PayPal and Stripe to accept payments in those apps to provide clients different payment opportunities.

Accounting

FreshBooks Double-Entry Accounting recognizes revenue details and their associated expenses, providing you with a correct calculation of profits and losses.

FreshBooks doesn’t produce accounting in the form of completely automated balance sheets, but you can simply capture all the information you want to file your business from the reports produced.

FreshBooks Double-Entry Accounting tools support you get choices based on real business information and insights.

More what you can get from Freshbooks accounting :

Reports

The software helps you create various sets of reports.

View them to get an idea of how objectives are performing with the business or print them out for your reference, team members, contractors, or even clients.

From your freshbooks dashboard, you can easily access relevant reports (like profit and loss).

Reports in FreshBooks have restricted customization opportunities, but they can be exported to Microsoft Excel for more personalization.

On the software advanced report section you can:

Mobile

FreshBooks has a magnificently created mobile app accessible on Android and iPhone and whatever you make on your phone will sync with your cloud accounts.

You may answer your customers’ inquiries and feedback directly from the application and never miss the updates.

You may also perform the following:

May Be You need this : My Recommended Tools

Integrations

To seamlessly integrate FreshBooks into your workflow and streamline your business operations, FreshBooks offers a vast ecosystem of over 100 integrations.

These integrations span various categories, including e-commerce, CRM, tax preparation, marketing, project management, and more. By connecting FreshBooks with compatible apps, you can automate tasks, centralize data, and enhance your overall productivity.

Time Tracking

According to thier Team, by switching to FreshBooks the average small business owner saves 192 hours* every year…

*based on a customer survey of more than 2,000 respondents

Breaking down the Features

What are the drawbacks of FreshBooks?

FreshBooks is a popular accounting software that offers a variety of features to help businesses manage their finances. While it's a great option for many, it's not perfect. Let's take a closer look at some of the pros and cons to see if FreshBooks is the right fit for you.

Here are what we find as cons of FreshBooks :

Cons

FreshBooks - Summary

Cost

Support

Simplicity

Resources

Reporting

Accessibility

Overall rating : 4 / 5 / more review here

Unlike the freshbooks classic, the new FreshBooks’ ease of use and great support put other services like Xero and QuickBooks Online to shame, which may make FreshBooks 100% deserving it for your company, especially, their offer of a 30-day free premium-feature trial.

Frequently Asked Questions

freshbooks vs quickbooks

How long is FreshBooks free trial?

What percentage does FreshBooks take?

Who owns FreshBooks?

Does FreshBooks do payroll?

What Others are Saying About Freshbooks

Any Freshbooks Alternatives?

freshbooks pricing

How Much Is FreshBooks Worth?

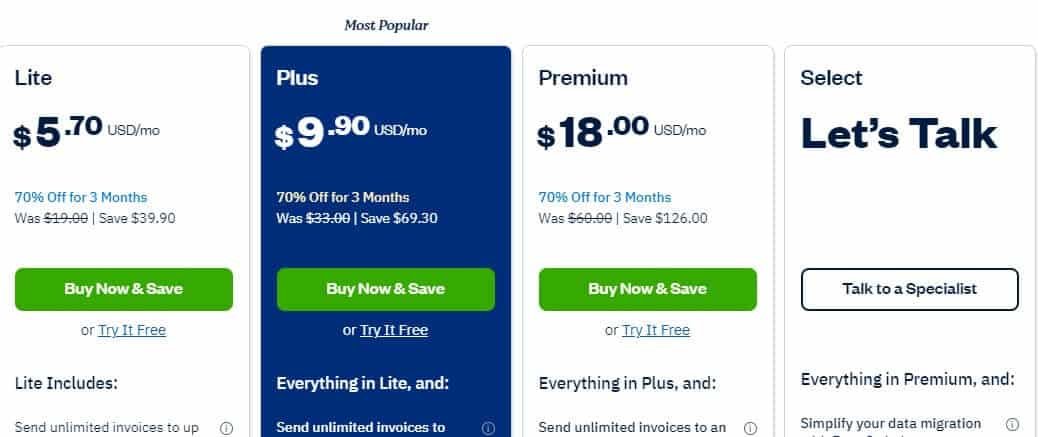

FreshBooks offers flexible pricing plans to suit businesses of all sizes:

- Lite: Starting at $5.70 per month, this plan is ideal for small businesses with up to five clients.

- Plus: Priced at $25 per month, this plan allows you to bill up to 50 clients and offers additional features like time tracking and expense management.

- Premium: For $50 per month, you can bill as many clients as you need, along with advanced features like custom reports and team collaboration tools.

Please note that pricing is subject to change and may vary based on your location and specific subscription terms. It's recommended to visit the FreshBooks website or contact their sales team for the most accurate and up-to-date pricing information.

The Select plan is for companies that need custom service with 500+ Billable Clients

Affiliate Disclosure

This article may contain affiliate links: means , if you click on one of these links and make a purchase ( which we appreciated ), then I'll receive a small commission without affecting the original price ( without costing you anything extra ).